Junior Lithium Miners

Welcome back to Borates Today. Today, we’re going to have a look at the lithium market and focus on junior lithium miners around the world. There’s no doubt that the lithium market is growing as the demand for sustainable and greener energy requiring lithium minerals increases. This has been beneficial to junior lithium miners working on smaller projects around the world.

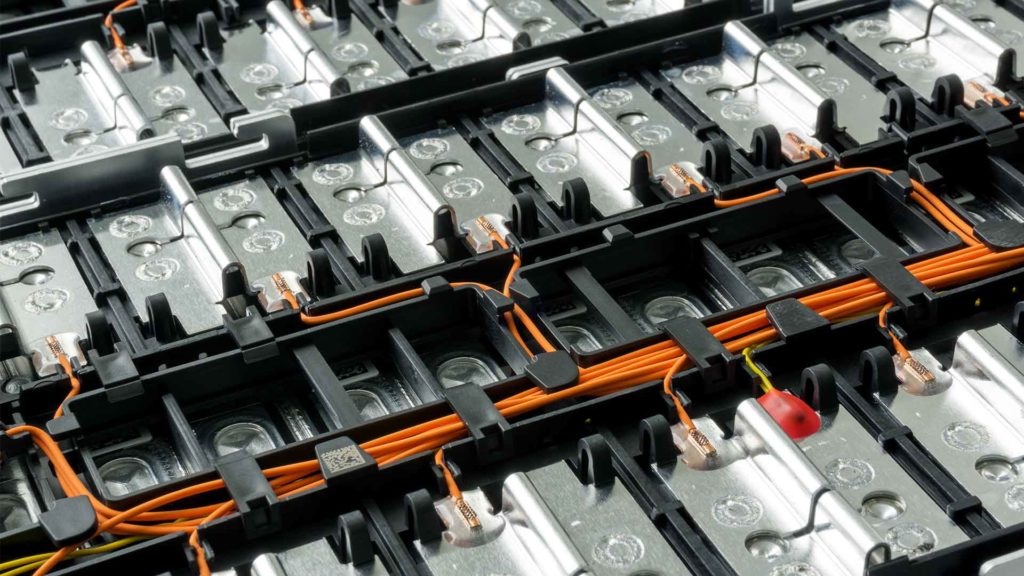

Lithium miners

Goldman Sachs expects lithium prices to climb higher due to Congress passing the U S climate bill. Canada has also made strides with a $3.8 billion critical minerals strategy. This will help speed up new projects related to these elements, which are crucial for clean, inclusive growth worldwide.

Meanwhile, Tesla co-founder JB Straubel’s, Redwood materials plan on investing heavily in battery recycling plants around South Carolina, further adding value towards modernizing the energies of today’s generation.

In contrast, Australia anticipates an eventual pullback in 2024 regarding supply and demand and production costs associated with mining these materials.

Meanwhile, in early 2023, many junior lithium miners have been impacted by price falls. Asian Metal has reported a decrease in spot prices across major lithium derivatives, dipping by 4.06%, and China’s Lithium Carbonate and Hydroxide dipped by 3.77%.

Let’s take a quick look at lithium miners who are poised for success in 2024.

Despite dropping prices, investors looking to get involved with small-scale operators should be aware that lithium miners’ mid to late 2020s production plans require a higher risk tolerance and longer timeframe than other stocks within the industry.

We’ll take a look at some of the junior lithium miners that could soar in the upcoming years. As a footnote, they’re classified as junior miners since they’re only likely to reach production after 2024.

In Australia, Lion Town Resources has made a bold commitment to the environment, signing a binding power purchase agreement to bring forth one of Australia’s largest emissions-free renewable facilities, which is the 95-megawatt hybrid power station in Kathleen Valley.

Leo Lithium Limited recently announced remarkable results from its Danaya resource drilling program.

A third company, Vulcan Energy Resources, has been making waves in the Australian lithium mining industry. It has it holds a respectable 15.85 million metric tons of lithium carbonate equivalent or LCE. And they claim to have Europe’s largest resource pool for this valuable mineral.

A fourth company is AVZ Minerals, which is affirming its claim on the Manona project through legal action, seeking to solidify. It’s 15% stake in one of the most lucrative lithium projects worldwide.

There are also Global Lithium Resources which has made a groundbreaking discovery at Manor and Marble Bar, with an immense 48 0.5% increase of lithium-rich resources to 50.7 megatons.

Galan Lithium recently achieved a major milestone with its acquisition of a hundred percent ownership in the Green Bushes South Lithium Project and is to commence a maiden drill program to unlock its mineral wealth.

Other companies to take note of include Rio Tinto, Essential Metals, Lithium Energy Limited, Winsome Resources Limited, and Neo Metals.

Moving to South Korea, POSCO is making a move in the battery materials market by investing heavily in Argentina’s saltwater reserves.

And if we look to Africa, Atlantic Lithium Limited took a major step forward with the award of their processing plant FEED contract to Primero.

Over in America, Ioneer has celebrated a milestone as the Rhyolite Ridge project finally reached the final stage of permitting. And Lithium Power International has taken a major leap with the purchase of water rights for their Maricunga Lithium Brine project.

American Lithium Corp also recently announced an impressive surge in lithium reserves. at their Tonapah Lithium Claims.

In Austria, European Lithium Limited has sealed a powerful partnership with BMW, finalizing an impressive binding lithium offtake agreement.

And if we move to Canada, frontier lithium has an extensive pegmatite deposit with 126.8 million tons of lithium ore.

Patriot Battery Metals has also announced the commencement of trading on the Australian Stock Exchange (ASX) and a successful 113.4-meter drilling result.

Green Technology, Metals, Nana One Materials, and Arena Minerals are other companies worth a look at.

In addition to the companies discussed, a number of lithium miners have announced their presence in the space, including 5E Advanced Materials, which has its sights set on becoming a dominant figure in the boron and lithium mining industry with an emphasis on promoting de-carbonization worldwide.

And that’s all for today. For those interested in more details, please look at Borates Today, where you can get all the links to these companies and more information.

Thanks for listening.