7 Amazing Facts About LFP Batteries

LFP batteries have been around since the late 1990s. But, it is only now that they are beginning to make their way into North America and Europe by redefining the market for batteries and EVs. These powerful, lightweight batteries can be charged quickly and cheaply—making them an attractive option for those looking to switch from traditional fuel-powered cars to electric ones.

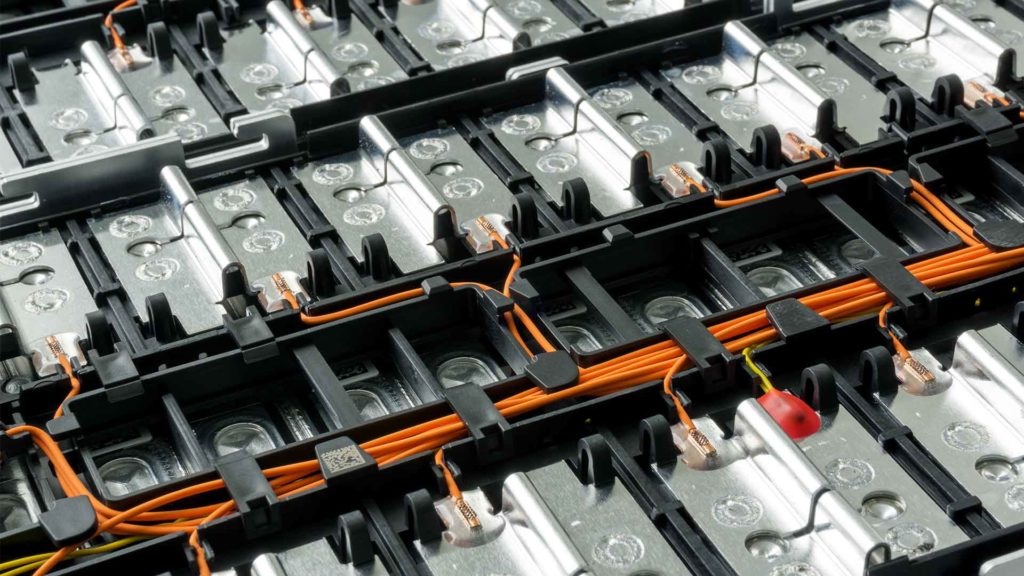

LFP batteries

1. LFP Batteries are Lithium-ion Batteries

LFP batteries are part of the larger family of Li-Ion batteries, which includes various battery chemistries with cathode names. While a LiFePO4 is a type of Li-Ion battery, not every Li-Ion battery is an LFP battery. The nickel manganese cobalt oxide (NMC) battery and the lithium nickel cobalt aluminum oxides (NCA) battery are two other lithium-ion batteries widely used in electric vehicles.

2. LFP Batteries can be Fully Charged

Whereas LFP batteries can be fully charged, charging an NMC or NCA battery to maximum capacity places it under extreme stress. It can result in accelerated calendar aging, a type of normal aging that occurs regardless of how often the battery is used.

Also, NMC batteries are highly unsustainable when completely charged because they convert chemical energy into electricity. Overall, avoiding a very high charge is considered the best option, with 80% becoming the average battery capacity for an ideal life.

Lithium Iron Phosphate batteries, on the other hand, are made with a lithium iron phosphate cathode, which enables them to have a charging capacity of 100% without accelerating battery degradation.

In the LFP cathode, the phosphorus-oxygen bond is more powerful than the metal-oxygen bond in all other cathode materials. This bond inhibits oxygen release and necessitates more energy and a greater on-set temperature for overheating. This increases the battery’s stability when stored at full load.

3. LFP Batteries are the Affordable Choice

The production of NMC and NCA batteries necessitates using nickel and cobalt. Purchasing both materials is already expensive.

As nickel and cobalt aren’t required for the cathode, LFPs currently avoid supply chain issues and high prices. Its cathode is made of rare materials.

LFP is a crystalline compound in the mineral family olivine. It is thus widely available for mining at a lower cost since the olivine family is a major element of the Earth’s upper mantle.

4. LFP Batteries Power 17% of the Global EV Market

The growing global demand for electric vehicles continues to drive research and development in the battery chemistry industry. LFP batteries are emerging as one of the top contenders in space, with 17 percent of the world’s EV market already powered by them.

Still, its future breakthrough may emerge from widespread adoption in different on-highway applications such as electric buses and trucks.

Despite warnings of a lithium supply shortage that could reduce global EV sales in 2030, LFP battery chemistry remains in high demand due to its several advantages over other chemistries.

Non-toxicity, lower ownership costs, long cycle life, and excellent thermal stability are all advantages. Because of these characteristics, LFP batteries are an appealing option for fueling electric vehicles of all sizes.

5. LFP Batteries to Achieve USD 49.96 Billion by 2028

According to the Globe Newswire, the lithium iron phosphate batteries market is expected to be worth USD 49.96 billion from USD 8.37 billion during 2020-2028, at an annualized rate of 25.6%. Several industry developments drive this rapid growth of the market.

The International Advanced Research Centre (IARC) for Powder Metallurgy and New Materials has created technology in April 2021 that will assist in manufacturing LFP cathode materials for lithium-ion batteries.

Toyota and Panasonic announced their intention in October 2020 to establish a joint venture for manufacturing lithium-ion batteries for hybrid vehicles in western Japan beginning in 2022. They believe it will assist them in meeting the increasing electric vehicle demand.

6. Market Drivers for LFP Batteries

With the need to reduce pollution, end-users have shown a strong interest in investing in LFP batteries. Manufacturers of grid and energy storage devices have strongly preferred batteries due to their small footprint, low self-discharge rate, and inexpensiveness. Furthermore, changes in lithium-ion battery prices have prompted the adoption of new technologies.

Meanwhile, the increasing use of lead-acid and lithium-air batteries through consumer devices, electric vehicles, and energy storage devices may harm the business outlook. In addition, the trend toward flywheel batteries is likely to threaten LFP battery manufacturers.

7. Key Market Players

As per Markets and Markets, the Asia Pacific region is expected to hold the highest market share for LFP batteries after the Europe. The advancement of automotive and power sectors in markets such as Japan, India, China, and South Korea is primarily driving it.

The major players in this market are BYD Company (China), A123 System (U.S.), K2 Energy (U.S.), Contemporary Amperex Technology Co. Ltd (CATL) (China), and Lithium Werks (China).