Boron Podcast – Billion Dollar Boron

Listen to this week’s podcast on Billion Dollar Boron, the companion to the article that helps you keep up to date on all things Boron by listening along.

Boron Prices are Going Up Sharply

Demand for Boron is creating eye-popping sales by Eti Maden, the world’s largest supplier of boron products with over 62% share of all sales. In 2021 alone, the company sold 2.6 million tonnes of boron products valued at over one billion U.S. dollars. Demand and, by implication, prices for the global supply of Boron will increase sooner or later.

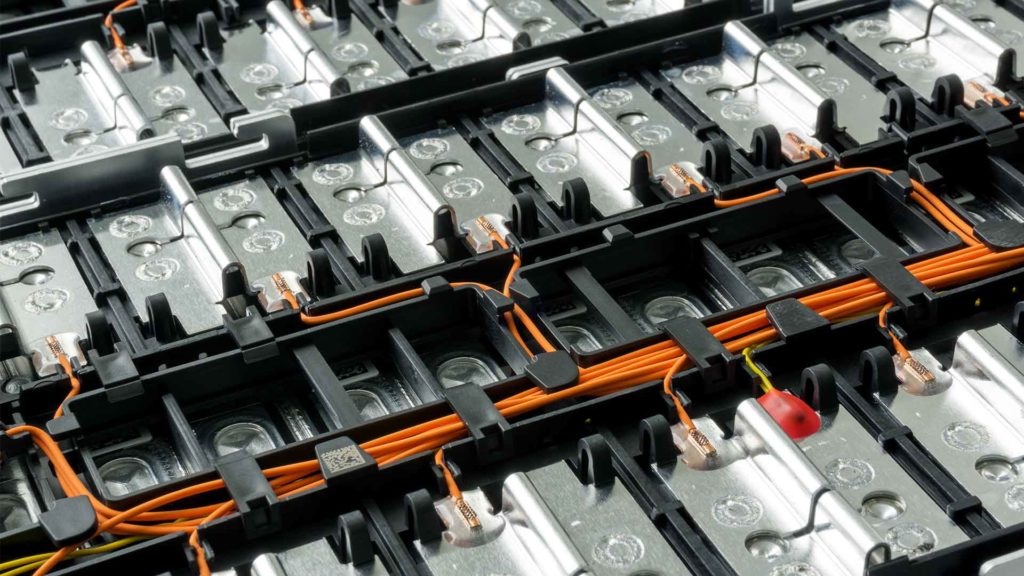

Boron is a vital ingredient in multiple business sectors from aerospace to automotive, construction, and defense. Boron is also increasingly used to support decarbonization initiatives and provide advanced energy solutions in powertrain magnets and batteries.

As prices for boron look set to rise, demand will not go away, given the strategic nature of the mineral’s use. Compare the supply and demand for rare earth minerals, a proxy for how things may play out. In 2020, M.P. Materials, a significant player in irregular earth mineral supply, forecast an EBITDA for 2023 based on a 60% increase in rare earth prices. Rare earths are in high demand in the same strategic industries and energy solutions as Boron.

According to research by Credit Suisse, demand for borates will outgrow supply within the next three years with substantial growth through 2030. Turkey and the USA – California deposits – account for 600-kilo tonnes of supply in 2020, growing to over 1,000-kilo tonnes by 2028.

Boron has significant applications in a Net Zero world. In a high growth scenario, demand for Boron could be 10x greater than current levels by 2050. By this time, over 90% of demand is coming from decarbonization technologies, including renewables, E.V.s, fertilizers, and insulation for building energy efficiency. The Credit Suisse report forecasts that Food Security needs to supply fertilizers and boron nutrients for plant growth. This will drive further substantial demand in the next 30 years.

Eti Maden: A Closer Look

![]()

Eti Maden

Eti Maden İşletmeleri Genel Müdürlüğü. Type. Eti Mine Works (Turkish: Eti Maden İşletmeleri Genel Müdürlüğü) is a Turkish state-owned mining and chemicals company focusing on boron products. In Turkey, where 70% of the world’s known deposits of borate minerals are found, the company holds a government monopoly on mining these minerals.

Through its long-standing history, Eti Maden is pursuing the future of Boron as it contributes to the growth of Turkey and the world economy by producing high-value-added Boron and boron products with product specialists in their respective fields. The world, especially Boron and boron products, is now seen in a different light.

Turkish energy and natural resources minister Fatih Dönmez announced last week that the country exported 2.5 million tons of boron products in 2021, exceeding the $1 billion mark (TL 11.9 billion) for sales of Boron.

The Turkish economy accounts for 62% of global sales of Boron. Dönmez stated that Turkey is the world’s leading producer of Boron.

“Despite the pandemic, we were able to set records in boron production, exports, and sales,” he said.

The question is, where does all this Boron go? Dönmez stated that Turkey’s Boron Carbide Plant will be completed by the end of 2022. The workshop was held at the General Directorate of Eti Maden, a Turkish state-owned mining and chemicals company.

Embracing this new facility, Dönmez explained, “Another important study we conduct on Boron pertains to ferrous Boron, which is primarily used in steelmaking. A contract for the production of Ferroboron with an annual capacity of 800 tons is being signed in Balıkesir. We will break ground for the facility in 2022.”

Eti Maden manufactures lithium from waste liquid boron. The company is continuing to manufacture lithium in a pilot plant in Eskişehir. Dönmez added: “The feedback we receive will be used to develop two facilities with a total capacity of 700 tons in Kırka and 100 tons in Bandırma. Tenders will be called to construct these facilities in 2022, and a new facility will be constructed in Bandırma in 2023.”

Eti Maden emphasizes the importance of domestic technologies. Tenmak-Boren has completed 342 projects since 2004 to develop and expand the use of boron products. Thirty-six projects remain in progress, and some of these projects have resulted in patents and production.

Eti Maden also produces lithium from liquid boron waste as part of its boron production. The construction of the new lithium facility is scheduled to begin in 2022.

Other Producers

There are relatively few mining companies supplying Boron to the world’s market. They all stand to benefit enormously from the spike in demand and subsequent price rises. Further, new mining projects are becoming harder to justify, and people power disrupts plans for new projects. Witness the suspension of the Jadar mine in Serbia in late 2021.

Borate producers who benefit include Eti Maden, Rio Tinto, U.S. Borax, Searles Valley Minerals, Minera Santa Rita, Borax Argentina, Quiborax, American Pacific Borates.

Eti Maden is a state-owned Turkish mining and chemicals company that focuses on boron products. Turkey has 72% of all known deposits.

Rio Tinto began mining in California’sCalifornia’s Mojave Desert more than 135 years ago. The company’s California boron operations supply about 30% of the global demand for refined Borates. They are located in one of the two largest borate reserves globally. For over a century, U.S. Borax has provided refined borates for industrial processes and agricultural and commercial purposes. The company extracts and refines borates at two locations in California and Argentina and then ships them around the globe. Rio Tinto owns the company.

The Fort Cady Borate Mine of American Pacific Borates Limited (ASX: ABR) in California is a multi-generational borate resource that includes boric acid, borate specialty material materials, gypsum, and potassium sulfate. ABR is a global leader in advanced materials production and is interested in high-value specialty fertilizer products and specialty fertilizer applications.

Searles Valley Minerals Inc., a company that produces and mines raw materials, is located in Overland Park. It operates in major areas in California, including Trona and the Searles Valley. Borax, boric acid, and soda ash are all produced by the company. Quiborax is the third-largest producer of boric acid in the world. It is a mining and manufacturing firm based in Chile’sChile’s Arica, Parinacota and Antofagasta areas. Its Surire mine, located at 4,050m above sea level in the Surire salt flat, is 157 km southeast of Africa.

ioneer’s Rhyolite Ridge Lithium-Boron Project will provide it with a firm foundation from which to build a profitable and sustainable business. Ioneer owns 100% of Rhyolite Ridge, a large, shallow lithium-boron deposit located near existing infrastructure in southern Nevada, USA.

The objective of Erin Ventures is to expand its mineral reserves by acquiring mining projects and developing current properties. Boron is estimated to be available at the Piskanja site for two decades. As part of the project, they will produce three essential products: colemanite (a calcium-based borate ideal for markets like glass and ceramics manufacturers that require low sodium content); ulexite (a mix of sodium and calcium borate essential for the fertilizer industry); and boric acid, a by-product that will be made on-site once the facility is operating.