Critical Minerals Crushed Share Prices

Many critical minerals shares have been hit hard in recent months as the prices of these commodities have declined sharply. While the overall market has seen sharp declines, shares of companies involved in the mining and production of these critical minerals have been hit even harder.

Critical Minerals

Critical Minerals Shares

Critical minerals are defined as those minerals that are essential to the economic and national security of a country. They are often used in high-tech industries, such as telecommunications, aerospace, defense, and clean energy.

The United States relies heavily on imported critical minerals, with China being the largest supplier. In 2021, the United States imported around 7700 metric tons of rare-earth compounds. This dependence has led to concerns about the security of the supply chain and the potential for political manipulation.

A number of critical minerals shares are traded on public markets. These include:

Albemarle Corporation

Albemarle Corporation (ALB) is a manufacturer of specialty chemicals with operations in three key areas: lithium, bromine specialties, and catalysts. The headquarter is situated in Charlotte, North Carolina. As of 2020, Albemarle is the largest provider of lithium for electric vehicle batteries.

Lithium Americas Corporation

Lithium Americas Corporation (LAC) headquartered in Vancouver, Canada, explores for lithium deposits. It owns interests in Argentina, in north-western Nevada; and in the Salta province of Argentina. The company was formerly known as Western Lithium USA Corporation.

Li-Cycle Holdings Corporation

Li-Cycle Holdings Corporation (LICY) Li-Cycle Holdings Corp. is headquartered in Toronto, Ontario and engages in the lithium-ion battery resource recovery and lithium-ion battery recycling business in North America. The company offers a mix of cathode and anode battery materials, including lithium, nickel, and cobalt, as well as graphite, copper, and aluminum; and copper and aluminum metals. It also provides lithium carbonate, cobalt sulphate, nickel sulphate, and manganese carbonate.

Livent Corporation

Livent Corporation (LTHM) was incorporated in 2018 and is headquartered in Philadelphia, Pennsylvania. It manufactures and sells performance lithium compounds primarily used in lithium-based batteries, specialty polymers, and chemical synthesis applications in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Sociedad Quimica Corporation

Sociedad Quimica Corporation (SQM), Sociedad Química y Minera de Chile S.A. was incorporated in 1968 and is headquartered in Santiago, Chile. The company produces and distributes specialty plant nutrients, iodine and its derivatives, lithium and its derivatives, potassium chloride and sulfate, industrial chemicals, and other products and services. It also provides specialty plant nutrients, including potassium nitrate, sodium nitrate, sodium potassium nitrate, specialty blends, and other specialty fertilizers.

MP Materials Corp

MP Materials Corp. (MP) headquartered in Las Vegas, Nevada, is a leading American rare-earth materials company. MP Materials owns and runs the Mountain Pass mine, the United States’ only functioning rare earth mine and processing facility.

5E Advanced Materials Inc.

5E Advanced Materials, Inc. (NASDAQ: FEAM) (ASX:5EA) is destined to become a highly integrated worldwide leader in boron advanced materials with a greater emphasis on decarbonization. FEAM is supported by its low-cost, low-impact boron commodity in Southern California, which has been designated as Critical Infrastructure by the US government and is the world’s biggest recognized new conventional boron deposit.

Source: All company references taken from Yahoo Finance profiles

Share Market Performance & Analysis

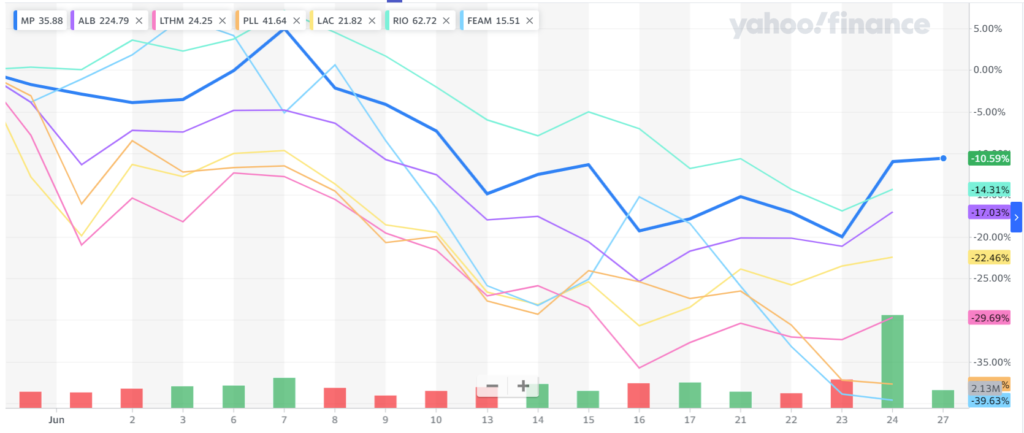

Critical Minerals 1 month chart, 27th June, 2022

Critical Minerals 1 week chart, 27th June, 2022

Source: Yahoo Finance, 2022

The past month has seen some big market movements, with the best performers being MP Materials Corp. (down by 6.6%)* and Albemarle Corporation (down by 5.4%). The worst performer was FEAM, which saw a massive 37.2% drop.

One big difference between FEAM and its better-performing peers is coverage. So far only a couple of brokers have issued reports and the company has only been trading on the NASDAQ since 15th March 2022. Also, FEAM is a recent addition to the NASDAQ so historical data is limited. Its 5EA CD is also down from its high. 5EA has a 52-week range of 2.1500-3.8400 and is currently trading at 44% below that high.

A paradox is that recent news for FEAM has been quite positive. For example, FEAM has been designated Critical Infrastructure, and the recent signing of an LOI with Cornings is now included on the Russell 2000 and 3000 indices. Further, FEAM is fully permitted and a new source for Boron in the USA. The Davison research report (FEAM) has a price target of US$36 which is 157% from the closing price on the 28th of June 2022.

Baird Equity Research is also positive about FEAM, given that demand is outstripping supply for boron and prices are increasing. Overall, the companies mentioned above, including Albemarle (ALB, Neutral), Li-Cycle (LICY, Neutral), and MP Materials (MP, Outperform) are receiving ongoing interest from investors and FEAM should benefit substantially as it comes online at the end of 2022.

* Calculation based on 27th June 2022 closing prices.