The Sodium-ion Battery Market and Reliance Industries

The Sodium-ion battery is a promising technology for electric vehicles, owing to its safer operation and inexpensiveness. Reliance Industries (India) aims to tap into this growing market with its extensive manufacturing capabilities and technology expertise.

How a Sodium-ion Battery works

A sodium ion battery is a rechargeable battery that uses sodium ions as the charge-carrying particles. Sodium ion batteries are similar to lithium-ion batteries in many ways, but they have advantages over their lithium counterparts.

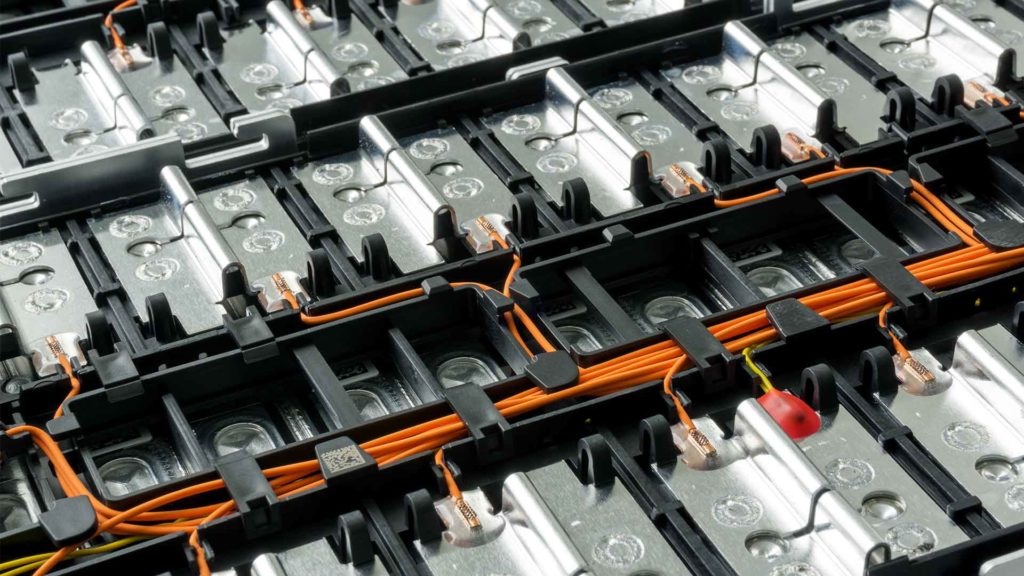

A sodium ion battery cell is made up of a cathode (sodium-containing substance), an anode (which is not always a sodium-containing substance), and a liquid electrolyte of dissolved sodium salts in protic or aprotic solvents. While charging, sodium ions are derived from the cathode and introduced into the anode even as electrons flow through the open circuit; during discharging, the sodium ions are derived from the anode and re-introduced into the cathode while electrons flow through the open circuit.

These batteries in electric vehicles are an emerging technology that holds great promise for the future of sustainable transportation. These are significantly cheaper and more environmentally friendly than traditional lead-acid batteries, and they have the potential to provide a much longer range for electric vehicles.

Here are some main reasons that make a sodium-ion battery a powerful alternative to a lithium-ion battery. Sodium-ion batteries are:

Cheaper to produce due to the wider availability of sodium ions than lithium ions

Lightweight, and thus electric vehicles can be managed more efficiently and effectively

Safer to operate than lithium-ion batteries. This is because sodium is less reactive than lithium, and thus there is less chance of a dangerous chemical reaction occurring during operation

More environmentally friendly than lithium-ion batteries.

Furthermore, a sodium ion battery provides excellent performance, density, and improved cycle percentage.

Sodium-ion batteries are getting popular and expanding their market due to their increasing use in renewable energy storage and electric vehicles. Recognizing this potential, Indian conglomerate Reliance Industries rewarded $135 million to Faradion Technology, a UK-based manufacturer of sodium-ion batteries.

Reliance Industries will Soon Produce Sodium-Ion Batteries

Mukesh Ambani, the chairman of Reliance Industries Ltd, has announced that his company will spend $76 billion on clean energy initiatives. One such investment for a greener future is sodium-ion battery technology, which aims to offer better options in India through lower costs and easier availability, facilitated by Faradions’ developments. Through this collaboration, reliance industries will speed up their commercialization plans by constructing integrated end-to-end Giga scale production facilities.

In a message to shareholders, Mukesh Ambani stated that in the next 5-7 years, reliance industries hope their green power segment (GPGP) to rise as a crucial engine for growth.

The investment portfolio includes the establishment of four giga factories, which are planned assets on top of last year’s announcement of a $10 billion three-year phase with motives including full integration at every stage from raw materials to end products; partnerships between different industries/sectors that can work together more easily due to similar needs; and funding future innovations.

He further stated that reliance industries would continue to develop their established businesses in technology, invention, scale, and implementation to accomplish net carbon zero by 2035.

Why do Reliance Industries believe Sodium-ion Battery is a Massive Opportunity?

The EV India market may be small, but it will not always be that way. Compared to scooters, which are a favored transportation mode for the middle class due to their low cost and greener image, especially in comparison to other transportation modes such as cars or motorcycles, the government has reduced the prices of electric vehicles.

According to Kotak, in 20 years, all two-wheelers and nearly 70% of auto sales will be EVs, and battery usage will skyrocket to $585 billion per year by 2052. The firm forecasts the potential stock-market capital investment from batteries in India is worth $1 trillion. Ambani can take a huge chunk of it by investing when others aren’t seeking.

Changemakers on a Global Scale

China’s CATL, the largest global manufacturing company of lithium cell batteries, launched its first sodium ion battery in July 2021. These new cells are predicted to have an energy content of 160 Wh/kg and a charging time of fewer than 15 minutes for 80%.

Sodium-ion Battery Market Analysis

As companies and consumers’ have become more aware of the benefits of sodium-ion batteries, the international sodium-ion battery market has also grown, especially in the electronic and electrical businesses. Processing sodium-based molecules with the same devices that control lithium-ion components may simplify automakers’ transition to sodium battery cells.

Sodium enables every nation to produce battery cells without relying on raw resources from countries like China. Sodium content in earth deposits is approximately 2.5% to 3%, or 300 times more often than lithium, indicating its advantages when producing batteries for electric vehicles because they are less expensive and have less volatile market prices. This could result in costs 30%-50% lower than most other batteries today.

According to research by Globenewswire, the market for sodium-ion batteries is projected to grow at an annual rate of 11.2% over the next six years, reaching almost US$2,500 million by 2028 from US$650 million in 2021.

Market Analysis by Type

The market is divided into three types: sodium-sulfur batteries, sodium-oxide batteries, and sodium-salt batteries. A sodium-sulfur battery is a liquid-state battery made up of liquid sodium and sulfur with a high power density, high charge and discharge efficiency, and long product life. This is driving the expansion of this market segment.

Market Analysis by End-user

The market is divided into several end-users: consumer electronic devices, transportation, power backup, grid-level applications, industrial, aerospace, defense, and marine. Consumer electronic devices and transportation applications powered by sodium ion batteries dominated the market by 6% globally in 2021 and are predicted to continue until 2028.

Market Analysis by Region

Regional segments divide the market into countries such as North America, Europe ( Spain, France, UK, Italy, Germany, Nordic Countries -Iceland, Finland, Norway, Denmark, Sweden), Asia Pacific (India, China, Australia, Japan, Southeast Asia, New Zealand, South Korea), Benelux Reunion (Luxembourg, The Netherlands, Belgium), Latin America, and The Middle East & Africa.

North America is much more likely to be beneficial due to its large-scale expansion of renewables such as wind and solar power and the rising market of electric vehicles.

Editor’s Note: Due to popular demand, we also publish articles on topics not focused on boron which are related to our Planet Boron strategic topics – Advanced Energy, Decarbonization, Food Security, and Micronutrients – where we consider the content to be pertinent to readers interested in boron and borates.