A Significant Shift in Lithium Battery Prices

Lithium battery pack prices have been steadily increasing since 2022, taking manufacturers and consumers by surprise. This sudden shift marks a significant rise in several years, a trend set to continue over the next few. It’s more important than ever for companies to understand what’s driving these increases to brace themselves against looming higher costs.

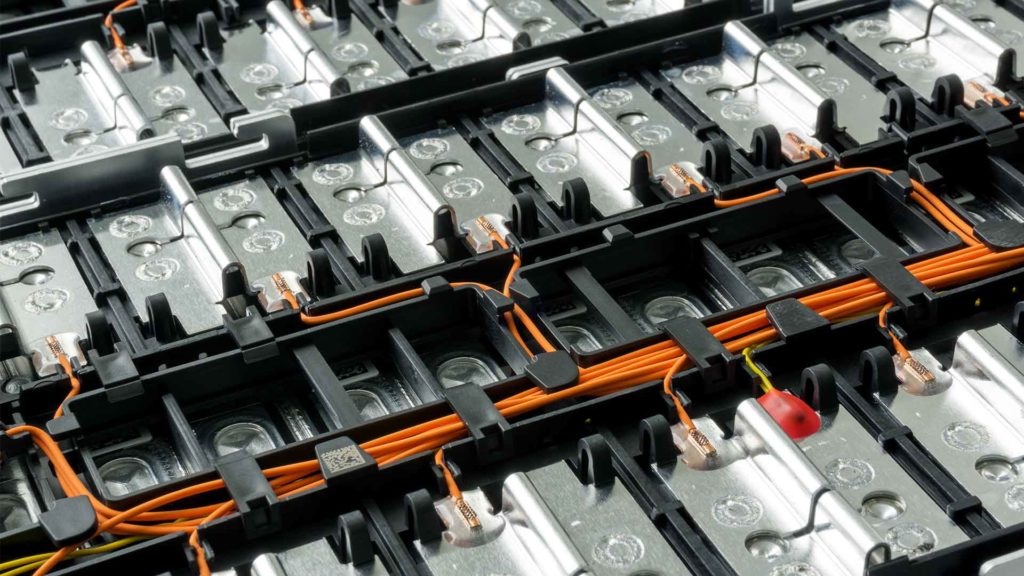

Lithium battery

Why Are Lithium Batteries in High Demand?

The surging demand for lithium batteries is not showing any signs of slowing down. As electric cars become increasingly popular, the need for more efficient battery technology increases. This means lithium batteries must be produced at an ever-increasing rate to power these vehicles.

In addition, many everyday items, like laptops, tablets, and smartwatches, rely on similar battery technology to operate. Consequently, the market for lithium batteries will keep expanding at a breakneck speed.

Thanks to its ability to store greater amounts of energy than other rechargeable batteries, lithium-ion technology has become one of the most sought-after energy storage devices available today.

It is estimated that by 2040 more electric vehicles will be on the road than those powered by fossil fuels. This means that lithium-ion batteries will likely remain a key part of the automotive industry for years to come.

Lithium Battery Prices Turn Positive for the First Time in Years

After a decade of consistent declines, lithium battery pack prices have taken an unexpected turn, electric vehicle and lithium battery energy storage system (BESS) pack prices have skyrocketed to US$151/kWh, the first significant increase since BloombergNEF’s surveys began in 2010.

This sudden jump comes after years of consistent declines driven by supply chain constraints, COVID-19 restrictions, and inflationary pressures – a sharp contrast from when costs averaged below US$100/kWh just two years ago.

The cost of lithium batteries has been steadily declining since 2010, with the average cost dropping by an impressive 89% to US$137/kWh in 2021.

This compares to last year’s 6% drop to US$131/kWh. As a result, BloombergNEF had initially predicted that pack costs would fall below the US$100/kWh mark by 2024.

However, due to increasing demand and supply chain challenges as well as other factors, BloombergNEF revised its prediction; it now expects cost declines to resume from 2024 and for prices to reach sub-hundred-dollar levels by 2026.

This could make electric car ownership more accessible and affordable for many people.

China is at the forefront of lithium battery supply chains because its packs are about one-fourth to one-third cheaper than other countries. Last year, China had some of the most affordable batteries available on the market – US$127/kWh.

United States prices were 24 percent higher than Chinese equivalents, and those offered within Europe were a staggering 33% more costly.

Prices on the Horizon in 2023

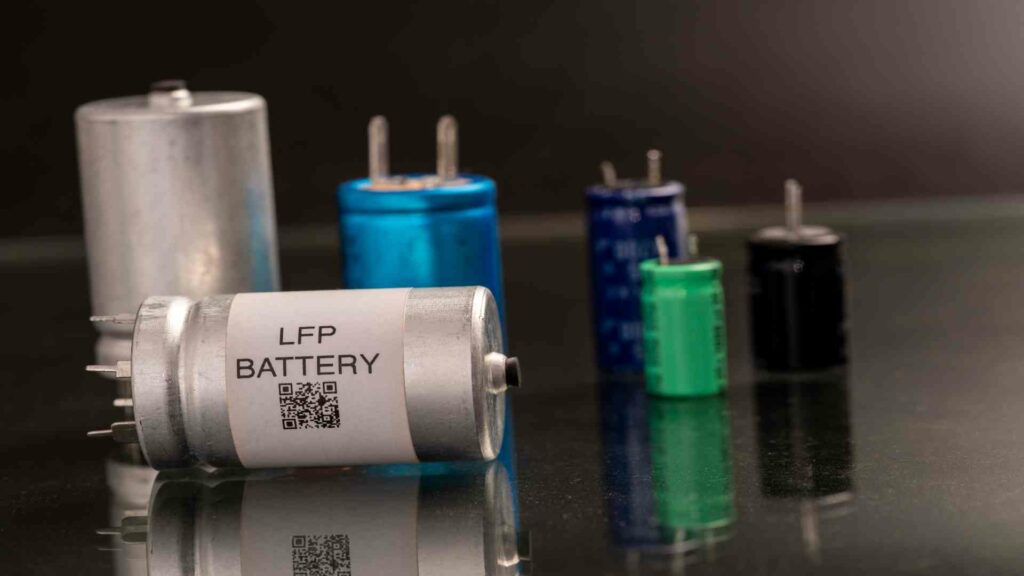

As lithium battery gains traction in the EV and BESS industries for its higher tolerance of physical abuse, increased thermal stability, historically lower cost than competitors, and lack of reliance on cobalt-based supply chains, rising demand has caused an unexpected increase in raw material input costs.

This renders lithium battery’s previous price advantage unsustainable as pricing rises alongside surging market popularity.

The increased demand for a lithium battery is a beacon of hope to investors, signaling that investing in raw materials extraction and processing – as well as factories producing finished products- is worth the risk.

This momentum will propel lithium battery costs down long term. However, it may take some time before new upstream resources become available to meet higher pricing demands of around US$152/kWh next year.

Kwasi Ampofo, Head of Metals and Mining at BloombergNEF, predicted that an influx in lithium supply later this year could help mitigate persistent constraints to the battery metals chain. Yet geopolitical tension remains a major source of uncertainty for prices moving forward.

To further compound issues, manufacturers are now gearing up improved production capabilities with next-gen technologies such as batteries fitted with silicon anodes or solid-state electrolytes – offering another potential avenue for price relief if adopted on a large enough scale.

The United States to Become Top Producer of Lithium Battery

The demand for lithium batteries is only expected to grow, and the U.S. will need to be prepared for a surge in employment opportunities related to this technology. The Department of Energy forecasts that the number of jobs related to EVs will reach more than 700,000 by 2030.

This includes producing batteries and designing, engineering, managing their use, and recycling them at the end of their life cycle.

These jobs are crucial in helping ensure battery production follows best practices and meets safety standards while offering potential career pathways for Americans who can help lead the transition toward clean energy sources.

High-skilled positions such as engineers and technicians with knowledge in electronics and renewable energy are particularly important, as they can help develop more efficient and cost-effective batteries.

Additionally, increased investment in research and development is needed to stay at the forefront of this rapidly changing industry.

The US is playing catch-up in this race, and the consequences of being left behind could be devastating. The nation must act quickly to build a sustainable battery manufacturing industry if it hopes to compete with China and other nations already well ahead.

To do so, the US must develop an integrated strategy encompassing all aspects of building a competitive battery supply chain, from research and development to manufacturing, logistics, and recycling.

This strategy must also include incentives for international companies to invest in domestic production and support services such as workforce training and financing options.

If done correctly, the US can create a powerful vertical battery manufacturing business that will provide long-term economic benefits while creating high-paying jobs for American workers.

Final Note

Manufacturing lithium batteries creates serious environmental issues, but their popularity means that usage is only expected to rise. Lithium battery is used in most electric vehicles currently being built, with Tesla as one of their biggest users. The increased demand for these batteries has led to a need for more responsible manufacturing and disposal practices to protect our environment.