What is ESG?

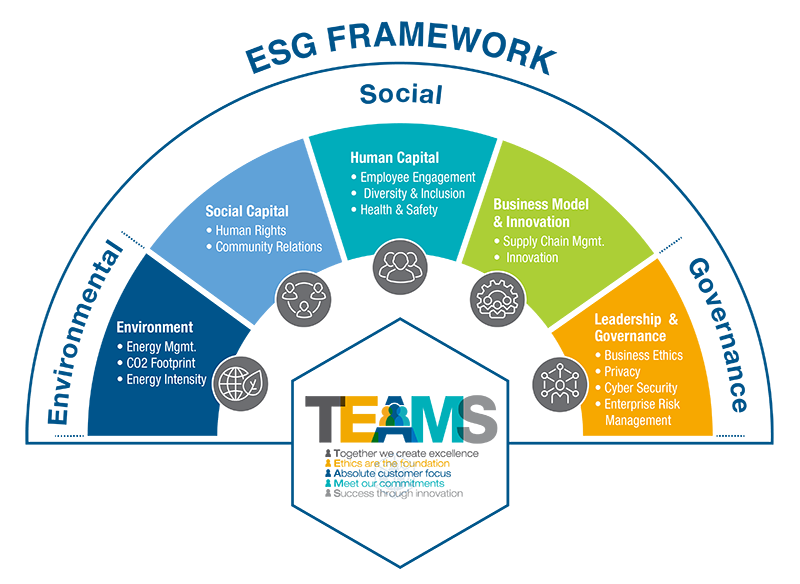

ESG is a set of practices that mines have to comply with to ensure their future sustainability. ESG stands for Environmental, Social, and Governance – the three pillars of ESG compliance. Environmental: ESG compliance is a mine’s responsibility to avoid pollution of water, land, or air. The mining industry needs to follow rigorous environmental standards. ESG also requires the company to maintain transparency in its dealings with stakeholders through regular communication such as public disclosure agreements (PDA). Social: Mining operations need to ensure good labor relations by providing their employees with fair wages. Additionally, they need safe working conditions as well as supporting reinvestment into local communities. Here, they can operate through donations, financial assistance, or employment opportunities. Governance: ESG regulations require that companies exercise good corporate governance practices. They need to have effective internal controls, auditing systems for financial reporting, succession planning, etc.The Impact of ESG on Mining Operations

ESGs are necessary for sustainability. They contribute towards three major aspects of mining operations: environment, socials, and governance. Miners need ESGs because without them their future would be at risk. It is very dangerous due to the lack of resources available. ESG governance at mining industries includes conducting an annual ESG performance review which identifies risks. They check the risks present within the company’s operations and provide plans on how these risks are mitigated over time. It helps in developing social guidelines such as policies governing conflict management, whistleblowing procedures, human rights protection, and more. Additionally, ESG appoints key personnel who are responsible for ESG compliance and ensure that the company’s ESGs are aligned with its operations.

Mining companies need Environmental Protection, Health, and Safety professionals who work on ESG related issues. This is to protect the environment as well as provide safety to employees. They need to conduct site inspections to identify potential environmental risks which are then mitigated. Thanks to their preventive actions such as implementing water conservation measures or upgrading equipment.

ESG governance at mining industries includes conducting an annual ESG performance review which identifies risks. They check the risks present within the company’s operations and provide plans on how these risks are mitigated over time. It helps in developing social guidelines such as policies governing conflict management, whistleblowing procedures, human rights protection, and more. Additionally, ESG appoints key personnel who are responsible for ESG compliance and ensure that the company’s ESGs are aligned with its operations.

Mining companies need Environmental Protection, Health, and Safety professionals who work on ESG related issues. This is to protect the environment as well as provide safety to employees. They need to conduct site inspections to identify potential environmental risks which are then mitigated. Thanks to their preventive actions such as implementing water conservation measures or upgrading equipment.

ESG is a powerful tool

ESGs play an important role in many mining industries. Mainly because it is committed to bettering the living conditions of communities near mining sites. They plan it through various means including providing training courses, microenterprise development programs, and more which promote sustainable livelihood opportunities. It also helps to achieve social goals like gender equality, increased employment rates among youth, and more. Overseeing organizations such as this one ensure that ESG compliance is met to protect communities near mines. Simultaneously, it is important to reduce operational costs and risks. This is good for business because it ensures that employees will be able to provide goods and services while following ESG standards. Socials play an important role too because they help educate those living nearby about how mining can positively impact their lives. ESG regulations ESG is a powerful tool that uses to protect the environment, communities, and employees. It ensures sustainable growth for all stakeholders. This means ESG can help mining companies today be more competitive tomorrow. ESG should become an integral part of any company’s operations. It is vital because it provides lessons to learn from other industries as well as global organizations that are experts in ESG initiatives.What does ESG mean for the Mining industry?

The World Bank reports that not only are there more extreme weather events due to climate change. They also say that because communities near mines will face an impact due to flooding from increased rainfall. Or sometimes due to landslides from heavier rainfalls, etc., This includes the mining community. ESG is an important consideration for future planning in this regard. ESGs are environmental, social, and governance issues that can impact a company’s performance. They are due to their various negative impacts on society or stakeholders when they’re not managed effectively. ESG needs attention from both management and shareholders as it covers environmental, social, and governance risks. ESG reports are around since the 1990s. However, they only became more common in recent years due to increased regulatory demands like Dodd-Frank Act (2010). This requires US companies to report ESGs annually starting in 2011. However, there is a disagreement over how effective these reports are because of inconsistencies such as data gaps and difficulty deciphering what constitutes the ESGs. ESG impacts mining operations. They can affect the day-to-day operation of a mine and its efficiency. Especially, when ESGS leads to regulatory or community opposition that reduces production by idling workers. It helps when the companies delay approvals for things like expansions. This may happen because ESG is often seen as more important than economic concerns by those who oppose mining projects. ESGs can also affect the quality of mining products. Particularly, when ESG standards or regulations lead to a higher cost of production that may result in lower-quality mined ores.How a Focus on ESG is Transforming the Mining Industry?

ESG is an emerging issue for boron mines. It is mostly because increased levels of regulation contribute to difficulties attracting investors. The difficulties are due to uncertainty about what ESGs are important. According to some estimates, there is at least $500M worth of lost investment opportunities over the past few years alone. It is generally due to ESG concerns expressed by potential investors. Two examples of this include new regulations in Peru and Mexico. These regulations require mining operations to have stricter environmental standards. Additionally, there is recent legislation from Canada which explicitly states companies cannot operate without meeting ESGS requirements. One way they can make a difference is by focusing on ESG integration from the start. ESG is at the heart of mining operations. They are not just an add-on to a project but rather they’re integrated into everything because ESG considerations should be leading every decision. This can mean location changes and even more types of mine.Is conventional ESG data failing mining companies and investors?

It is a complex issue. They are not just an add-on to mining operations but represent how companies conduct their business. ESG data should be integral to any company’s decision-making process. And they can empower investors by providing clearer insight into ESG risks. Numerous studies show that investing time and resources into ESG integration from the start leads to increased productivity levels. It is because planning for these issues before they happen allows mining operations staff to better prepare themselves against potential disasters. For this shift towards ESGs to take place, we need more ESGF. Environmental Social Governance Framework. These standards and improved communication between industry stakeholders help on ESGs to fit within different industries.What is an ESG Framework?

ESG is the social and environmental impacts of your business activities. The data is integral to any company’s decision-making process for a few reasons. It can empower investors by providing clearer insight into ESG risks. This allows mining operations staff to better prepare themselves against potential disasters. Source: https://www.cubic.com/about/environmental-social-governance

Why should any mining operation pay attention to them? In today’s world, there will always be some form of risk with enterprises operating worldwide or even locally. The change helps to create some level of predictability for ESG impacts, such as risks or opportunities. ESGs can provide clarity and a better understanding of a company’s performance about that enterprise’s business activities which is important for risk management purposes.

Source: https://www.cubic.com/about/environmental-social-governance

Why should any mining operation pay attention to them? In today’s world, there will always be some form of risk with enterprises operating worldwide or even locally. The change helps to create some level of predictability for ESG impacts, such as risks or opportunities. ESGs can provide clarity and a better understanding of a company’s performance about that enterprise’s business activities which is important for risk management purposes.

Where does ESG Framework come into play?

The Environmental Social Governance Framework (ESGF) provides an umbrella framework. It helps simplify the process by outlining requirements related to ESG Disclosure. This also encourages good communication between stakeholders within different businesses. It is for those who are not used to working with one another on these issues. They may generate mutually exclusive data sets previously. This will help start conversations across industries. So we can build more consensus around how ESGs should be implemented throughout mining operations.Mining sustainably

Understanding ESG Disclosure is essential for risk management purposes. It is vital to understand ESGs within an organization, external stakeholders, investors, and other interested parties. This will help with determining what ESG issues are most relevant and their potential impact on profitability. ESG involving labor typically includes things like discrimination against women or minorities. Or not providing a safe work environment. It can also involve the treatment of indigenous populations and allocating them to mines with very poor working conditions. The final ESG related to mining is environmental degradation. It includes things like deforestation to build roads for mining operations, as well as water pollution that affects nearby communities.

ESGs have been found within many different countries around the world. In Turkey where borax production was studied between 1915-1941, it was determined that SO emissions led to both increased acidity levels in local wells and higher mercury content in those same wells. The ESG’s surrounding labor often include discrimination against women and minority groups without any protections, as well as human trafficking. In India ESG’s include child labor and the overuse of pesticides to keep mining operations free from pests.

The final ESG related to mining is environmental degradation. It includes things like deforestation to build roads for mining operations, as well as water pollution that affects nearby communities.

ESGs have been found within many different countries around the world. In Turkey where borax production was studied between 1915-1941, it was determined that SO emissions led to both increased acidity levels in local wells and higher mercury content in those same wells. The ESG’s surrounding labor often include discrimination against women and minority groups without any protections, as well as human trafficking. In India ESG’s include child labor and the overuse of pesticides to keep mining operations free from pests.