ABR CONSIDERING PARTNERS FOR BY-PRODUCT LITHIUM PRODUCTION

Giving impetus to its drive to be a substantial player in the advanced energy eco-system of the region and beyond, American Pacific Borates Limited (ASX:ABR) (ABR or the Company) is exploring partner options for a potential by-product lithium production from its Fort Cady Integrated Boron Facility in Southern California.

Improving lithium economics, and emerging Direct Lithium Extraction (DLE) technologies have propelled the new move for the Company, even as its primary focus would remain boron specialties’ business, a top ABR executive has said.

LITHIUM AS A BY-PRODUCT IN THE ABR FORT CADY INTEGRATED BORON FACILITY

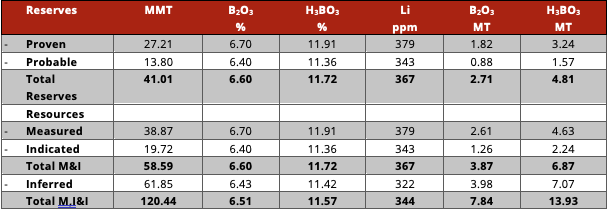

Current Fort Cady JORC code compliant Mineral Resource Estimate contains 120.44m tonnes at 334 ppm Li which is equivalent to 214k tonnes of lithium carbonate equivalent with substantial exploration upside.

The US Advisory Board led by John Mitchell has suggested the Company should explore partner options for the extraction of the lithium that remains in process water after the extraction of boric acid and gypsum without derailing itself from its primary focus to be in the boron specialties’ business and current engineering and test work associated with enhancing the solution mine and process plant. Secondly, the big push to the lithium economics in the current Calendar Year makes the timing opportune for those involved in the entire value chain, while improving DLE technologies are making extracting lithium from the Fort Cady Integrated Boron Facility’s waste stream economic.

The partner option for its potential by-product lithium stream would enable the Company to grab opportunities to enhance some boron specialty applications currently under consideration including LiBor salts for lithium-ion batteries.

The proposed partnering strategy will be jointly led by the Advisory Board given their deep lithium networks, the Company currently working through a process to ensure a strong listing on a recognized New York exchange, has said.

The Company is striving to become a fully integrated producer of boron specialty products and advanced materials and is targeting boron applications in the field of clean energy transition, electric transportation, food security amongst other high-performance, high-tech, and high-margin applications. The global shift from fossil-based systems of energy production to renewable energy is increasingly important to the global consumer and economies. The emergence of renewable energy, the onset of electrification, and improvements in energy storage are all key drivers of clean energy transition, pushing governments’ thrust on zero-carbon footprint energy solutions.

Boron is a key component in energy transition because it is highly versatile in chemical reactions and can be applied in processes for storing chemical and electrical energy, amongst other applications.

Global access to mined boron is rare and the Company’s production is underpinned by an even more rare and large colemanite deposit. Colemanite is a conventional boron mineral that has been used to commercially produce boron for broad applications for centuries. The Fort Cady colemanite ore deposit is the largest known contained traditional borate occurrence in the world not owned by the two major borate producers Rio Tinto and Eti Maden. The JORC compliant Mineral Resource Estimate and Reserve comprises 13.93Mt of contained boric acid.

In addition to its forte in boron, the Company is evaluating lithium by-product production from the boric acid plant streams and has identified a purge stream from the gypsum production circuit as the potential lithium production source. Filtration is being evaluated as a potential process step for lithium extraction, the Company’s DFS summary noted.

GREEN ENERGY: BORON SALTS FOR LITHIUM-ION BATTERIES

With lithium batteries, the ideal power sources for a variety of devices and machines, prone to catching fire when overcharged or overheated, there have been battery safety concerns from the transportation sector, including airplanes and hybrid-electric automobiles. Boron-based batteries have a higher threshold for charging. Known for having a higher energy density than lithium, there is mounting evidence to indicate that it could power tomorrow’s technology. It can sustain high temperatures without melting, which is why scientists are exploring its potential in areas like advanced hybrid car engines and batteries, notes yet another scientific article published by Borates.Today entitled “Demand for Key Metals like Boron in EV Production Rapidly Rising”.

The Physical Chemistry Chemical Physics Journal published by the Royal Society of Chemistry published a paper entitled “New boron-based salts for lithium-ion batteries using conjugated ligands” emphasizing the role of boron in lithium-ion batteries. The paper presented a new anion design concept, based on combining a boron atom as the central atom and conjugated systems as ligands, which is presented as a route for finding alternative Li-salts for lithium-ion batteries.

Boron is less reactive than lithium, making it a safer chemical to use when creating batteries for anything from cell phones to cars, because of its low reactivity with other compounds or chemicals. It also has higher potential energy than lithium which it gives off in ionized form, making it more efficient at storing power over a smaller area, notes an article entitled “Boron and Lithium – which is the mightier?” published by Borates.Today.

With global economies understanding the consequences of global warming and thrust on green energy by the US and the European Union, mining companies and those in the value chain of critical minerals and sustainable energies would get more traction from investors in days to come.

(Source: www.nasdaq.com/articles/renewable-stocks-to-pick-as-ipcc-sounds-alarm-bells-on-climate-change-2021-08-16)

In addition to the flagship Fort Cady Integrated Boron Facility, the Company also has an earn-in agreement to acquire a 100% interest in the Salt Wells North and Salt Wells South Projects in Nevada, USA on the incurrence of US$3m of Project expenditures. The Projects cover an area of 36km2 and are considered prospective for borates and lithium in the sediments and lithium in the brines within the project area. Surface salt samples from the Salt Wells North project area were assayed in April 2018 and showed elevated levels of both lithium and boron with several results of over 500ppm lithium and over 1% boron.