Boron and U.S. Rare Earths Stockpiling Policy

The U.S. is boosting the stockpile of its rare earth minerals such as cobalt and lithium. Why? Partly to reduce dependence on China and partly to have a strategic policy towards rare earth sourcing and distribution. Rare earths are valuable resources used in E.V. batteries and decarbonization. What is the stance on boron and U.S. rare earths as a critical mineral?

Boron US Rare Earths Strategy

Memo on Agreement Signed in February

The Pentagon will increase the stockpile of rare earth minerals, cobalt, and lithium to decrease its dependence on China for the long term. The Pentagon will need lithium, which is a crucial component in producing electric-vehicle batteries, to achieve its goal to reduce its non-tactical vehicle fleet to 170,000.

Nearly a year ago, U.S. President Joe Biden issued an executive directive to examine U.S. supply chain resilience in February 2021. The new stockpile agreement guidance will be announced in late February 2022.

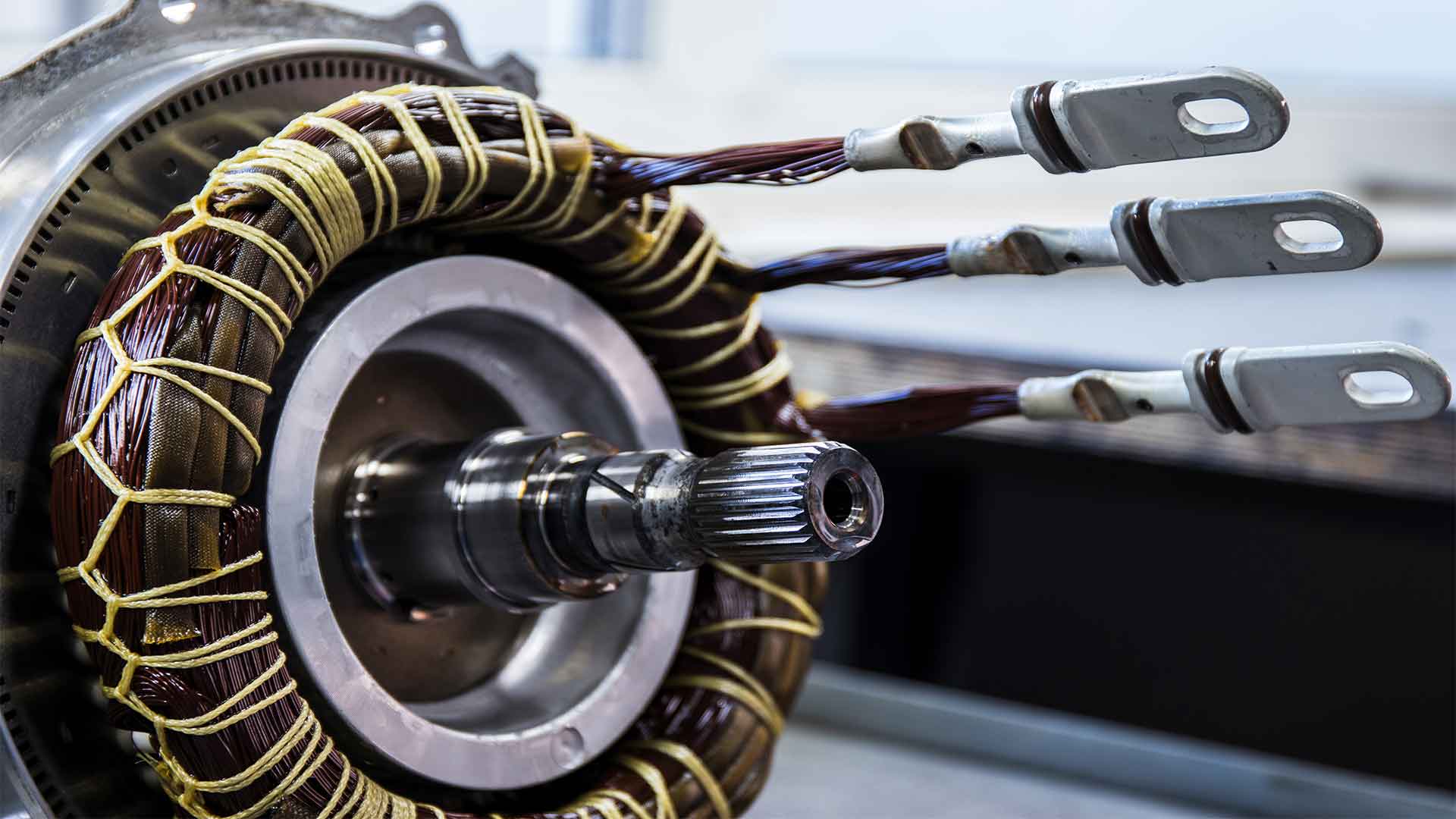

After processing, a group of 17 metals called rare earths can be used to create magnets for electric vehicles, weapons, and electronics. U.S. military researchers have developed the most popular type of rare-earth magnet since World War 2. They have been used in next-generation weapons like the Lockheed Martin Corp (LMT.N) F-35 jet and Raytheon Technologies Corp (RTX.N) precision-guided munitions.

However, China has gradually seized control over rare earths over the last 30 years. With over 60% of the world’s rare earth global production, China is the undisputed leader in the category, enabling itself to dominate the value chain with rare earth magnets. In 2020, of the 36,000 tons of rare-earth magnets exported by China, 13.7 per cent of shipments came to the U.S.

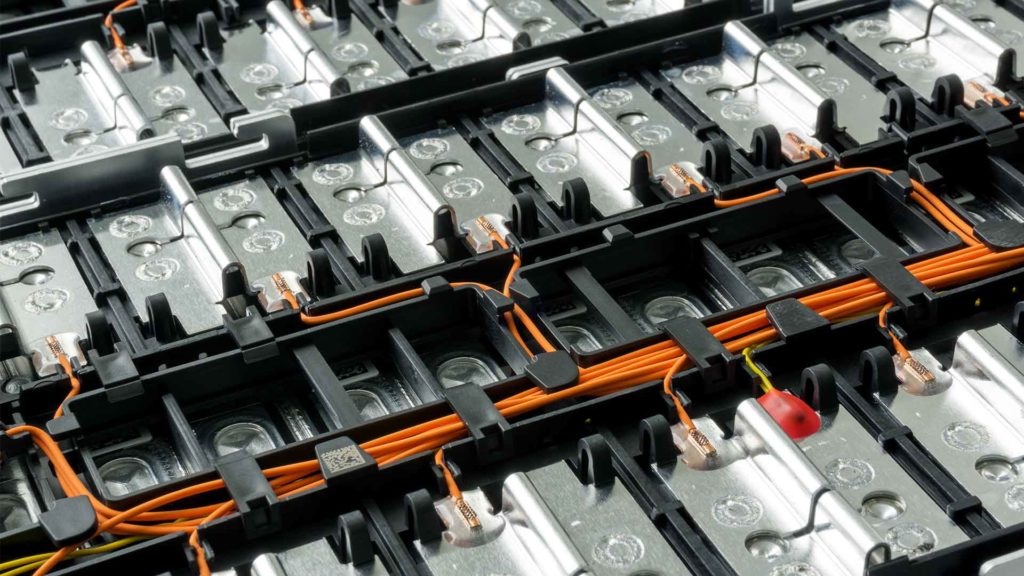

In February, the Departments of Energy, Defense, and State signed an agreement that covers select materials and large batteries used in the electric grid. The memo directs inter-agency coordination for an unclassified stockpile of relevant non-fuel minerals. This is necessary to facilitate a transition towards more sustainable technologies. This agreement allows other U.S. agencies like the Department of Energy to coordinate and draw from these stockpiles.

The United States has one rare earths mine and no facility for processing rare earth minerals. Much junior lithium and rare earth miners hoped that the Pentagon would purchase more domestic products. The Pentagon continues to buy supplies from China to date to build reserves. This paradox is something many Capitol Hill members are keen to change over time.

Rare earths production creates significant pollution. This is why public sentiment towards extraction and production is unfavourable in the United States. The process is being made more environment-friendly through ongoing research into sustainable extraction and communication of societal benefits.

What are Rare Earths?

Seventeen metallic elements make up the rare earth elements (REE). These include the fifteen lanthanides on the periodic table plus scandium and yttrium.

Many high-tech devices require rare earth elements. According to the U.S. Geological Survey’s news release, “Going Critical,” rare earth elements (REE) are essential components of over 200 products in a wide variety of applications. This includes high-tech consumer products such as cell phones, computer hard drives, and electric vehicles. Electronic displays, lasers, radar, sonar, and guidance systems are critical defence applications.

The amount of REE in a product might not be significant by its weight, value, or volume, but it can still be essential for the device’s function. Magnets made from REE are often only a fraction of the product’s total weight. However, spindle motors, voice coils, and desktop and laptop computers would not work without them.

Boron – permanent magnets

Boron as Rare Earths

Wind turbines and electric vehicles are just two of many sectors that will need rare earth elements. Depending on the scenario, the demand for clean energy technologies should be primarily regulated by market dynamics expected between 3% and 10%.

While the world shifts towards green energy for one reason or the other, it is clear that the future of green energy is heavily reliant on rare earth minerals and their untapped potential in hardware as a means to increase the efficiency of current equipment and as a tool to be developed into a clean energy source of its own.

The most effective way to balance the market in the short term is by curbing demand. It can be done by promoting innovation and green technologies while working towards climate ambitions at a product level, reducing consumption of rare earth elements, and substituting more friendly alternatives such as boron.

Shi-Bo Cheng, Cuneyt Berkdemir, and A. W. Castleman, Jr. from the Department of Chemistry and Physics at Pennsylvania State University have shown that boron-doped lanthanide superatom clusters mimic the valence electron configuration of certain rare earth elements and may serve as rare earth analogues. Their work is published in the Proceedings of the National Academy of Sciences. Boron has applications in the field of nuclear, wind, solar energy.

A new development in wind turbine technology has made direct-drive turbines a viable option for customers. With rare-earth magnets, weight is reduced, and maintenance issues are eliminated, making this an attractive investment opportunity. The most popular generator used in wind turbines is a boron-inside permanent magnet. They’re used in offshore turbines because they produce high power density and small size with the highest efficiency at all speeds. These generators offer a low lifetime cost for sizeable annual production of energy.

Boron is to be utilized as an energy storage medium, showing its potential benefits. In the framework of solar systems development, boron has been found to reduce power loss during the transfer from areas with high productivity levels. Producing hydrogen or building up transmission lines makes a significant amount of energy loss that can range between 50%-60%.

Boron power systems promise to provide emission-free energy from smaller reservoirs than hydrogen by using fireproof substances. Boron’s high specific binding energy and the undemanding nature as cargoes of both it and elemental boron means they will convey points lightly and compactly, even in small shipments.

If successfully demonstrated, boron-powered vehicles would show the ability to run on public roads without depending on unique fueling stations since their ash could be sent away by any common freight carrier.

Producing Rare Earth Magnets Using Boron

Rare earth magnets refer to permanent magnets comprising an alloy of neodymium, praseodymium, iron, boron, terbium, dysprosium, or an alloy of samarium gadolinium and cobalt.

With greenhouse gas emissions raising global concerns for sustainable yet accessible energy sources for a greener future, these minerals have of late found their applications and adaptabilities in the alternate energy ecosystem. With countries transitioning from fossil fuels to alternate energy, these rare earths like neodymium (comprising neodymium, iron, boron), boron, and praseodymium have proven themselves as drivers for clean energy applications and high-tech industries, are in the spotlight, particularly as America aspires to EV-based mobility.

Neodymium magnets (Nd-Fe-B) are rare earth magnets composed of neodymium, iron, boron, and a few transition metals. A Neodymium magnet is a permanent magnet that uses the power of neodymium (NdFeB), one of the strongest substances known. It exhibits superior resistance to heat and corrosion and a high tolerance for ferromagnetic materials in close contact with it. The NdFeB magnet accounts for most global rare earth permanent magnet production.