BORON CITED IN US BILL TO FUEL AMERICA’S ALTERNATE ENERGY TRANSITION

Boron is giving a shot in the arm to North America’s alternate energy transition initiatives, a Democrat in the U.S. House of Representatives has introduced legislation to extend tax credits to companies that domestically produce rare earth magnets with boron and other minerals inside.

The Rare Earth Magnet Manufacturing Production Tax Credit Act of 2021 will empower those engaged in the value chain of manufacturing rare earth magnets, thus bolstering the efforts of the U.S. to switch to cleaner, greener, and sustainable energy sources to power decarbonization and complete the alternate energy transition.

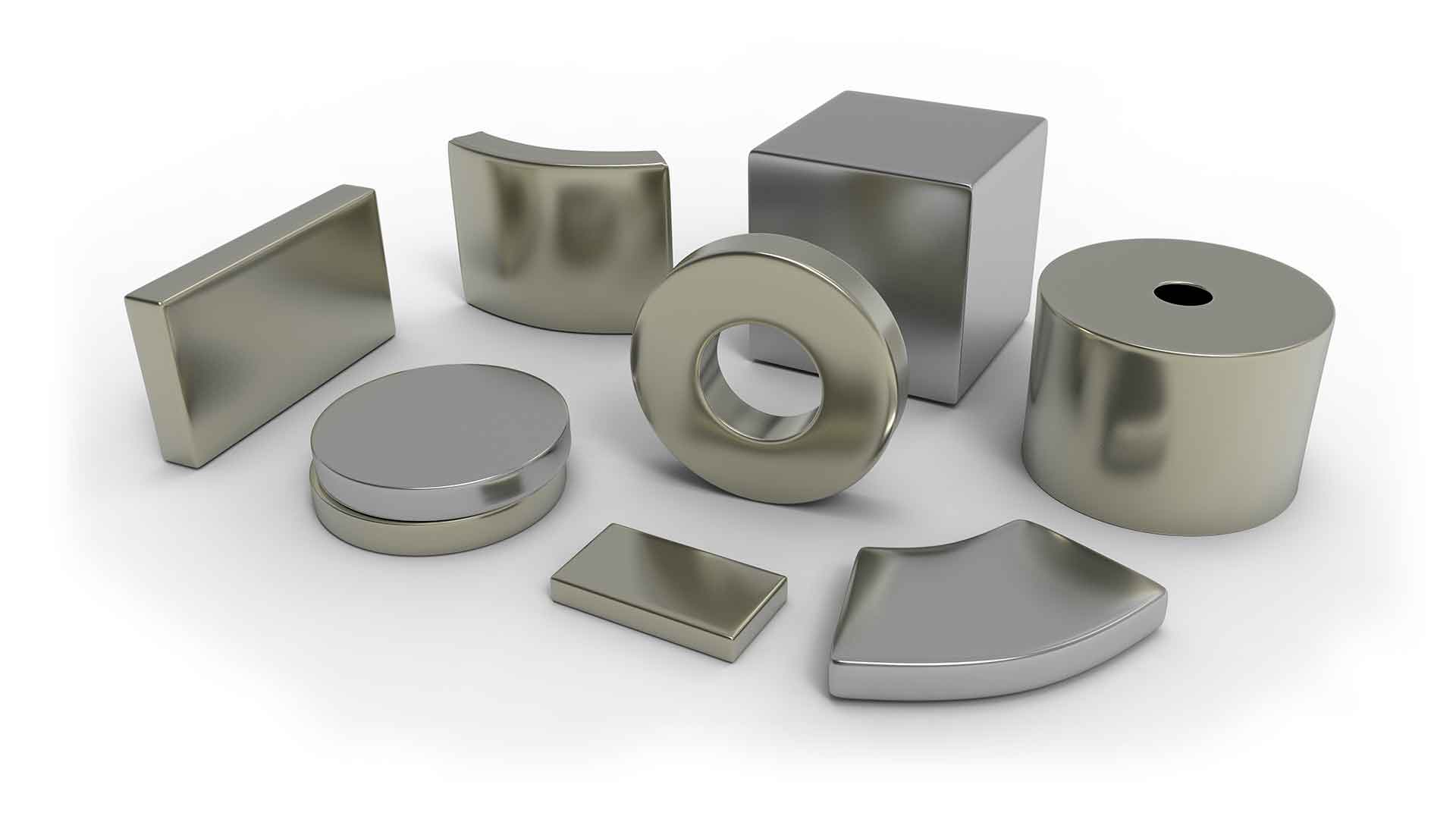

Rare earth magnet refers to a permanent magnet comprising an alloy of neodymium, praseodymium, iron, boron, terbium, dysprosium, or an alloy of samarium, gadolinium, and cobalt.

With greenhouse gas emissions raising global concerns for sustainable, yet accessible energy sources for a greener future, these minerals have off-late found their applications and adaptabilities in the alternate energy ecosystem.

The bill entitles credit for the production of $20 per kilogram of rare earth magnets manufactured in the U.S., or $30 per kilogram in case of rare earth magnets manufactured in the U.S. comprises rare earth material magnet components soured from mines within the U.S. Manufacturer of a rare earth magnet would encompass an entity involved in alloying, reduction, strip casting, and metalization of component rare material, the bill states.

A taxpayer is not eligible for the credit with respect to a rare earth magnet if any component rare earth material used to produce such magnet was produced in a non-allied foreign nation, it adds.

The amendments made by this Act shall apply to taxable years beginning after December 31, 2021.

The bill attempts to change the supply-demand scenario in this region heavily dependent on China for imports of rare earth magnet industry supplies.

With over 60% of the world’s rare earth global production, China is the undisputed leader in the category, enabling itself to dominate the value chain with its production of rare earth magnets.

In 2020, of the 36,000 tons of rare-earth magnets exported by China, 13.7 percent of shipments came to the U.S.

The geopolitical friction between the two economic giants, however, has brought attention to the supply chain issues in the rare earths industry that saw President Biden giving orders for a full executive review of the supply chain of critical materials. The President wants to use the power of collaboration with American allies to bring balance to the economy that surrounds the rare earth magnet industry, Borates Today reported.

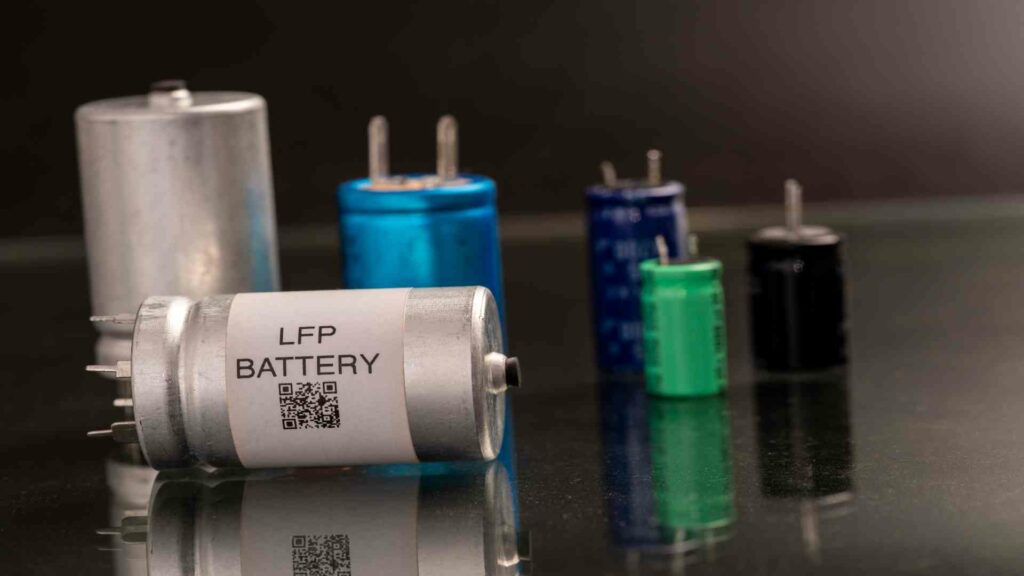

With countries transitioning from fossil fuels to alternate energy, these rare earths like neodymium (comprising neodymium, iron, boron) boron, and praseodymium, which have proven themselves as drivers for clean energy applications and high-tech industries, are in the spotlight, particularly as America aspires e-mobility.

Meanwhile, the American call to minimize greenhouse gas emissions has found an ally in Europe that has been aspiring to go carbon neutral. The EU is reported to have been working on proposals to jump-start home output of a type of specialist magnet vital in electric car motors by offering support to local producers, mirroring the U.S. legislation.

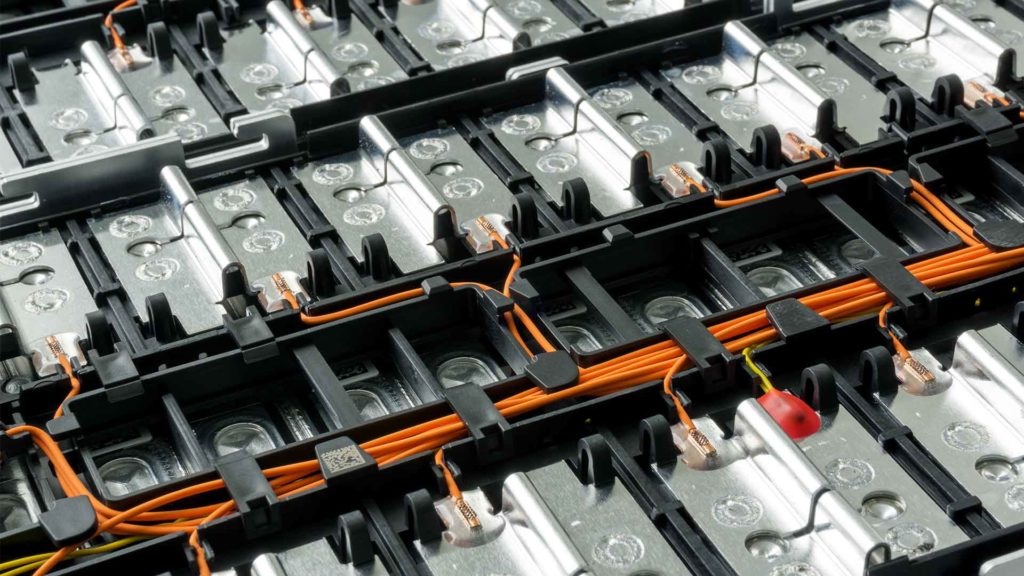

In April 2021, the U.S. Department of Energy (DOE) had awarded $19 million for 13 projects in traditionally fossil fuel-producing communities across the U.S. to support the production of rare earth elements and critical minerals vital to the manufacturing of batteries, magnets, and other components important to the clean energy economy.

NEODYMIUM MAGNETS

Neodymium (Nd-Fe-B) are rare earth magnets composed of neodymium, iron, boron, and a few transition metals. A Neodymium magnet is a type of permanent magnet that uses the power of neodymium (NdFeB), one of the strongest substances known. It exhibits superior resistance to heat and corrosion, as well as elevated tolerance for ferromagnetic materials in close contact with it.

Today, the NdFeB magnet accounts for the majority of global rare earth permanent magnet production.