Introduction to Critical Minerals in Australia

The Australian Government has announced its intention to become more self-reliant in critical minerals as a result of geopolitical changes which threaten the ongoing supply of key industrial and energy commodities, which includes boron and borates.

Critical Minerals in Australia

Demand for resources is now going beyond traditional commodities. Technological development and the demand for minerals such as boron and lithium is critical to sectors such as defence, aerospace, automotive, renewable energy, telecommunications and agritech.

Australia produces around half the world’s lithium, is the second-largest producer of cobalt and the fourth-largest producer of rare earths.

The need for robust supply chains has been highlighted by the COVID-19 pandemic. Countries are increasingly seeking access to reliable, secure and resilient supplies of the critical minerals they need. Australia’s large critical minerals reserves, technical expertise and track record as a reliable and responsible supplier mean the sector can respond to market demand.

The strategy “sets out a long-term plan to leverage growing global demand and develop a thriving and durable Australian critical minerals sector – one that contributes to the national security and economic prosperity of Australia and the Indo-Pacific region”.

Government Support

The Australian government established the $2 billion Critical Minerals Facility in 2021. The facility is administered by Export Finance Australia. It will help projects aligned with the Critical Minerals Strategy overcome gaps in private finance to get off the ground. This will support jobs and communities, particularly in regional Australia, and bolster a strategically important sector in the Australian economy.

$200 million has already been committed to its Critical Minerals Accelerator Initiative to support strategically significant projects, the funding will accelerate supply of minerals for strategic industrial sectors.

Further, a $50 million virtual Critical Minerals Research and Development Centre is also being set up in coordination with Geoscience Australia, CSIRO and the Australian Nuclear Science and Technology Organisation to support new initiatives with industry partners.

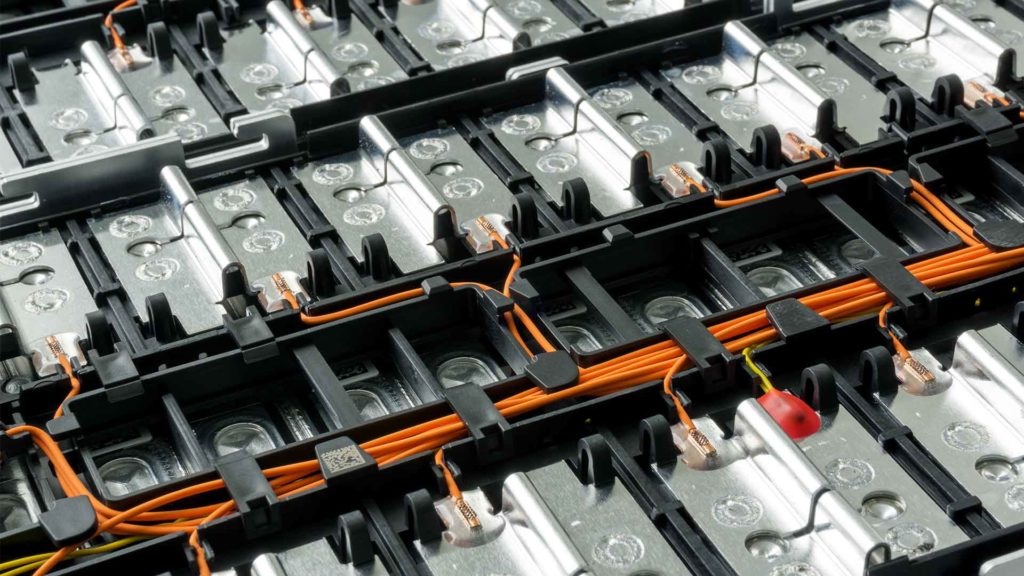

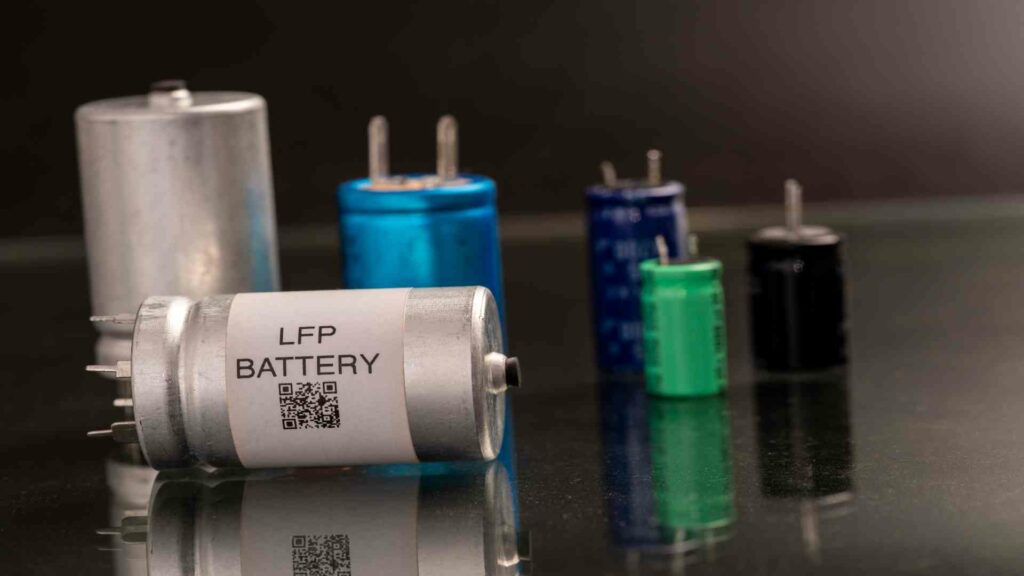

With the new strategy, Australia’s mining industry will be able to produce more of the raw materials needed to make products for the above sectors such as steel, glass, ceramics, magnets, batteries and solar panels.

Projects are accessing grants under the Modern Manufacturing Initiative and concessional finance through the Northern Australia Infrastructure Facility. The Australian Government is investing heavily in establishing strategic international partnerships on critical minerals and working with the states and territories to establish regional hubs.

The support and funding is likely to help companies such as Global Geosciences, a producer of boron and lithium.

Global Geoscience – Boron and Lithium, Australia

Australia-based lithium-boron developer Global Geoscience (ASX: GSC) is looking to become a major player in the US for critical metals, as it expands into the American market.

An independent pre-feasibility study (PFS) conducted by Amec Foster Wheeler lends credence to the development of a new $599 million lithium and boron mining and processing operation at the company’s 100%-owned Rhyolite Ridge property in Nevada, USA.

Production started in in 2021, and predicts at least a 30-year mine life, with the opportunity to expand to produce 20,200 tonnes lithium carbonate and 173,000 tonnes boric acid per year. Boron is a key mineral in multiple industrial uses from glass to high strength steel, and increasingly in strategic sectors such as aerospace and defence, advanced energy and agritech.

According to Global Geoscience, the Boron co-product will create enough revenue to cover nearly all the operating costs and enable Rhyolite Ridge to be the lowest cost producer of lithium in the world.

5e Advanced Materials

Another Australian entity is set to become one of the most significant suppliers of Boron (and lithium) to global markets, albeit out of its facility in California. Recently listed on Nasdaq, and also listed on the ASX in Australia, 5e Advanced Materials, formerly known as American Pacific Borates, has declared significant supplies of boron (as well as lithium) and been granted a licence for extraction and supply.

Conclusion

This strategy complements other major national initiatives, including: Global resources strategy, modern manufacturing strategy, technology investment roadmap, and the critical minerals strategy. These strategies work together to create jobs and increase the economy during the current crisis.

Note on Australian Minerals

Australia is a large producer of many important minerals including: iron ore, coal, gold, copper, zinc, lead, nickel, silver, lithium, bauxite, molybdenum, uranium, manganese, phosphate, potash, chromium, vanadium, titanium, tantalum, tungsten, zirconium, niobium, tin, rhenium, antimony, germanium, yttrium, thorium, lanthanum, cerium, neodymium, europium, gadolinium, dysprosium, terbium, holmium, erbium, thulium, ytterbium, praseodymium, samarium, lutetium, hafnium, scandium, indium, gallium, selenium, tellurium, polonium, radium, astatine, actinium, radon, protactinium, americium, curium, californium, einsteinium, fermium, lawrencium, dubnium, livermorium, meitnerium, osmium, palladium, platinum, promethium, technetium, rhodium, iridium, and ruthenium.