The Threat of a Boron Market Shortage

So let’s get to today’s topic. We’re going to look at the demand and supply for boron, which is changing rapidly. With new applications demanding boron’s use in decarbonisation and green energy, as well as the traditional applications related to agriculture feeds and commercial applications for glass and ceramic ware, boron is becoming increasingly valuable as a strategic mineral.

Today’s podcast, the threat of a boron market shortage.

Well, first, what is boron?

Boron is a metalloid element found in minerals and rocks, usually combined with other elements, such as oxygen or magnesium. Boron is also present in seawater, but only at deficient levels. Plants absorb boron from the soil and use it to build strong cell walls. Animals that eat plants can also get boron in their diet.

What are the applications and demand for boron?

Boron is a crucial element in many industrial and military applications. It’s used as a dopant in semiconductors, to create smooth surfaces and lower thermal expansion for professional catering and laboratory use. These glasses and ceramics are also widely used in phones, cars, and house construction.

Boron is also used as an additive to solar panels, where it plays a critical role. It decreases the reflexivity while increasing the efficiency of solar panels. The solar market is expected to grow at more than 20% per year until 2026.

Looking to the future, by 2050, wind and solar are expected to generate up to 70% of the world’s electricity. With the electricity generation increasing 2.5 times over the same period, boron’s use in both technologies will undoubtedly be a huge boon to the industry.

On top of that, boron is also an essential component in the production of neodymium magnets, which are notably found in wind turbines.

Let’s look a bit at the production of boron.

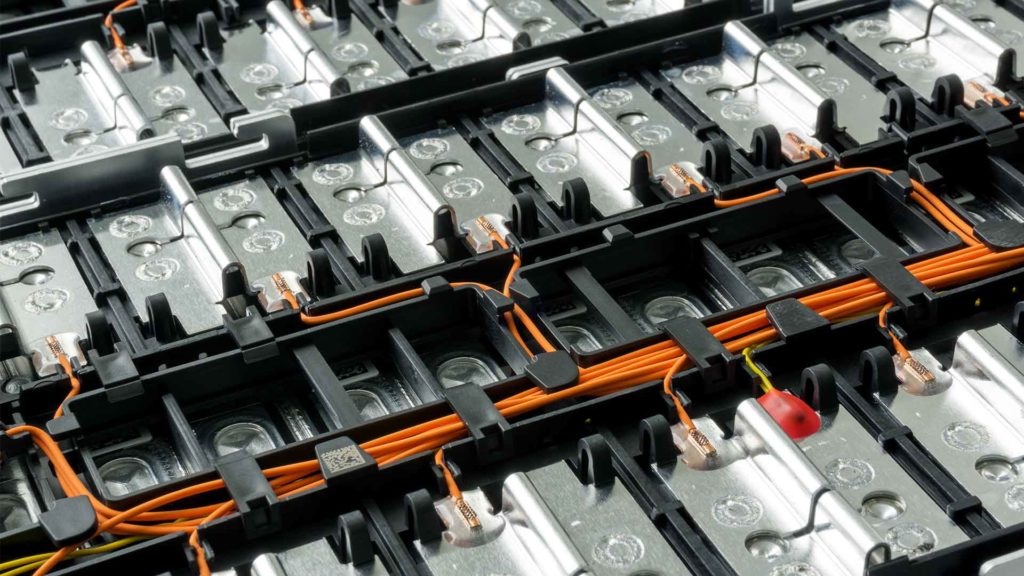

Currently, boron is only produced in a few countries. Like lithium, boron has a small supply chain with limited resources, but demand is rapidly increasing, for instance, for use in powertrains in electric vehicles. 5e Advanced Materials, FEAM, estimates that various boron compounds make up around 2.5 to 3% or 46 kilograms to 50 kilograms of an EV weight. It’s expected that the EV, or electric vehicle market, will grow from approximately 6.3 million units sold in 2021 to between 26.8 million and 34.8 million by 2030. Boron’s use in EVs appears to be another area of explosive growth.

However, EVs aren’t the only use for permanent magnets. All modern vehicles use them to some extent. They’re used to improve fuel efficiency by assisting with crank shaft rotation. Other applications include the manufacture of various electronics, disk drives, and actuators.

Samarium cobalt magnets are the most common alternative to neodymium magnets. But they’re typically used only in the defense and aerospace industries. The market for permanent magnets containing boron is currently projected to grow to 23.4 billion by 2027, up from 16.4 billion in 2021.

It seems like the boron market will grow steadily over time. For now, the production gradually declines as existing deposits deplete, which results in an imbalance between demand and supply, leading to higher prices, e.g., $1,250 per ton, which exceeds previous estimates of $739 per ton.

Credit Suisse predicts that boron demand will rise significantly within three years. As a result, the relative need for boron will increase rapidly, and these elevated prices are likely to continue.

With glass and ceramics manufacturing accounting for approximately half of boron’s commercial usage, and fertilizer accounting for about 20%, there is plenty of growth for boron in traditional uses.

New uses in solar panels, neodymium magnets, and advancements in advanced materials all offer explosive growth opportunities that significantly reduce the element’s reliance on the existing revenue streams. However, there may be even more opportunities for boron’s use to expand as new applications for the element emerge.

Again, according to Credit Suisse, boron demand could grow more than tenfold by 2050 under a high growth scenario. At that point, decarbonization technologies would account for more than 90% of boron demand. This is a sector that currently accounts for only a small portion of boron’s demand and is positioned to become the most important in the future.

While the next five years appear promising, the next couple of decades could be a game-changer for the boron market. So perhaps it’s not just the short term that investors should concern themselves with. And with this in mind, now could be a great time to get involved in this exciting industry.

Looking at the boron supply profile, presently, the boron supply chain is relatively weak. Turkey accounts for 60% of global boron sales, with state-owned Eti Maden, controlling the production. Eti Maden and Rio Tinto, the latter producing most of its boron in the United States, account for 85% of the total boron supply.

” You can literally count all of the boron deposits in the world on one hand,” says Tim Daniels, CEO of Erin Ventures.

There are relatively few projects going into production shortly. Notably, the Fort Cady, California project, owned by 5e Advanced Materials, is the latest to get a license to produce boron.

Rio Tinto’s Jadar, Serbia project, Ioneer’s rhyolite Ridge, Nevada project, Erin Ventures’ Piskanja, Serbia project, Bacanora’s El Cajon, Mexico project, and Euro Lithium Borates’ Rekovac, Serbia project, are other projects which are potentially coming on stream.

Looking at 5e Advanced Materials Fort Cady asset, we can see it represents a required source of incremental borate supply in the United States, and likely globally, that’s distinguished by its highly convenient location for domestic consumption, as opposed to obtaining from overseas, i.e., Turkey, which currently supplies 84% of boron-related imports to the U.S..

This gives 5E the advantage of a small environmental footprint, and with additional ESG initiatives in the works, solution extraction, geothermal potential, the company is looking forward to a ripe future.

For those seeking investment opportunities, boron appears to be in a similar position to lithium. 10 years ago, lithium had a relatively limited supply chain with extraction concentrated primarily in South America and Australia and was dominated by a few companies. Because demand was not particularly high, and applications offered only limited growth, there was little investment in the sector. When EVs became popular, however, the market was racked into action, and the lithium market grew tremendously.

When a rare mineral becomes essential, it becomes significantly limited quickly, and in the case of boron, it’s not that we will run out of the mineral but the market will create demand rapidly in the future, and supplies may be limited.

In 2010, lithium was selling for $5,160 per ton. While spot prices have now risen to more than a hundred thousand dollars per ton, the long-term contract price for lithium appears to be closer to $22,000 per ton. This is perhaps the kind of proxy for the future for boron. However, boron deposits appear to be far more scarce than lithium deposits.

Boron prices were as low as $569 per ton in 2020. However, the increase to $1,250 per ton this year indicates that the market appears to be gearing up for the upcoming shortage and will only enhance soon.

In the first quarter of 2022, 5e Advanced Materials quickly emerged as a strong player in the boron market. It’s a boron miner seeking to establish the boron project in Southern California as one of the major players.

5e has the largest known boron deposits that Eti Maden or Rio Tinto do not own, and is destined to become the third-largest boron producer with the arguably unique ability to utilize boric acid feedstock to integrate into more value chains vertically.

The company is currently engaged in developing a fully integrated and diverse portfolio of boron plus advanced materials business with the primary emphasis on green end uses that enable decarbonization.

And that’s all from Borates Today. For more information on boron and demand and supply, please visit the Borates Today website. Thanks for listening.