BORON | CRITICAL MINERALS : The Current Scenario

Critical minerals are vital for technological advancements and the manufacturing prowess of a country. Moreover, they play a strategic role in national security and the supply of state-of-the-art military equipment. This explains why governments around the world are working on procuring these critical minerals.

As the Biden administration tackles U.S mining, new Energy Secretary nominee Jennifer Granholm voiced complete support for marshaling federal power to ensure steady domestic supplies of critical minerals such as boron, cobalt and lithium.

What are the issues?

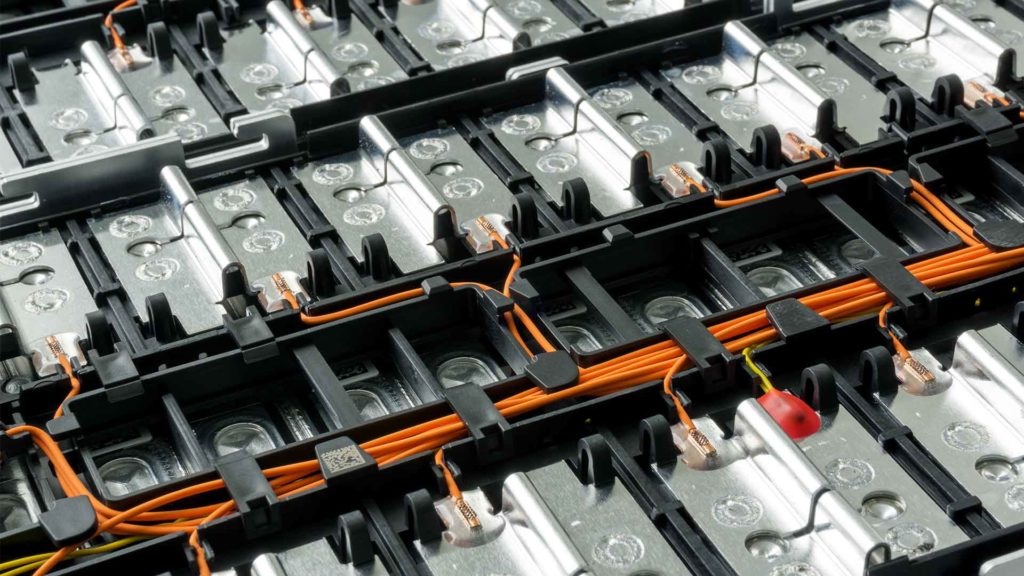

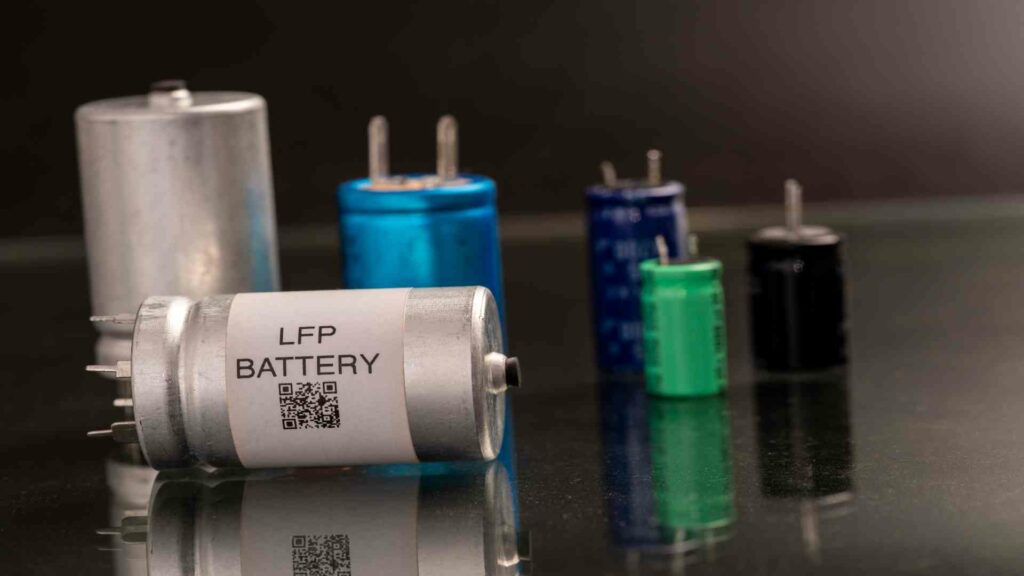

According to an article published in the Wall Street Journal, the USA and its allies are looking hard to find trustworthy companies with an established record and the capability to provide domestic supplies of lithium and boron to assist decarbonization goals and advanced energy projects such as electric vehicles (EV), satellites and wind turbines.

“The Senate this month approved a bipartisan, $250 billion bill to boost government spending on technology research and development to catch up with China, including funds for digging up and processing critical minerals at home and with allied nations.”

Source: WSJ: ‘U.S. Plans to Spend Big on Critical Minerals; Choosing Where Isn’t Easy’ 21st June, 2021

This investment will help the U.S. secure supplies and invest in competent boron mining and processing facilities, preferably in the USA, which can provide these critical minerals. However, given the shortage of reliable domestic partners, multiple investments have also been made overseas in Canadian and Australian processing facilities.

The China Factor

Another factor is the amount of processing needed to make the mined materials into functional elements and advanced levels of skills and expertise sparingly exist out of China. “Many producers will find it difficult to compete head-to-head against China on price without some level of ongoing government assistance,” according to Constantine Karayannopoulos, chief executive of Neo Performance Materials ULC.

Elsewhere, as China mines over 70% of the world’s rare earth minerals, it has a near-monopoly in rare earth minerals. The U.S. Government currently finds itself funding joint rare-earth processing facilities with China to secure supply.

Spotlight on the rare earth magnet industry

Of all the uses of rare earth minerals, the production of solid magnets stands to be one of the most important ones by far. They are used in every major to minor industry. Our phones, Bluetooth devices, laptops, and multiple household devices make use of rare earth magnets.

As China controls rare earth magnet industry supplies. President Biden gave orders for a full executive review of the supply chain of critical materials and wants to use the power of collaboration with its allies to bring balance to the economy that surrounds the rare earth magnet industry.

Europe’s response to rare earth mineral supplies

Elsewhere, recognizing the need for rare earth minerals, multiple industries in Europe have partnered up to form the Rare Earths Industry Association (REIA). The group has representation from countries worldwide and is the only rare-earth trade association based outside of China.

Europe’s concerns over the current rare earth market

Currently, Europe imports more than 50% of China’s produce and believes that the market’s concentration in one country does not qualify as fair trade. The importance of critical materials for Europe extends well beyond needs for current production purposes.

Europe’s mission to increasingly decarbonize its industries stands on the availability of necessary materials because materials like boron and Lithium are essential to increase the efficiency of existing machines and reduce carbon dependence in the short and the long run.

European countries push for fairer access

European countries have been serious about the issue since 2010 and have adopted specific strategies to reduce their dependence and encourage global collaboration.

- Diversification of Supply – All countries agree that while it may be impossible to be completely independent of China’s supply, it is essential to have more suppliers and give countries real options and introduce competition that drives down financial exploitation.

- Investments into exploratory projects – Countries have commissioned several companies to look for more undiscovered mining sites, and they’ve been successful in their mission so far. However, maintaining adequate labor costs and maintaining operations by the increasingly stringent environmental laws is proving to be complicated. Moreover, the development of technology to process all raw material into usable products is still lacking.

- Recycling of the existing critical minerals – Countries are looking at recycling old machines and vehicles to salvage rare earth materials and recycle them for further use. This way, they can reduce the rare minerals in circulation and increase recycling efforts.

- Development of substitutes – All countries are looking at developing alternatives to rare earth materials such as magnets made from other elements that do not require rare earth or using different methods for extracting critical minerals.

Conclusion

Governments around the world are faced with challenges when acquiring strategic critical minerals such as boron and lithium that contribute to decarbonization and advanced energy programs. They must balance investment programs in innovation for industry, research and development policies, national security policies without compromising overall environmental impact in the future. Strategies include investment in procurement with allies at home and abroad as well as direct investment into the limited number of mining and extraction companies who are able to provide access and supply of minerals.

Since the Paris Agreement, companies have to be mindful of cutting down on their carbon dependence to achieve the goal of being carbon neutral by the year 2050. If we want to reduce carbon emissions and clean energy, then we must focus on how to make the supply chain of critical materials more transparent and accessible to developing countries and come up with a world trade system that eliminates the risk of hoarding and unchecked control of natural resources in the hands of a few suppliers.