Country Profile of Russia

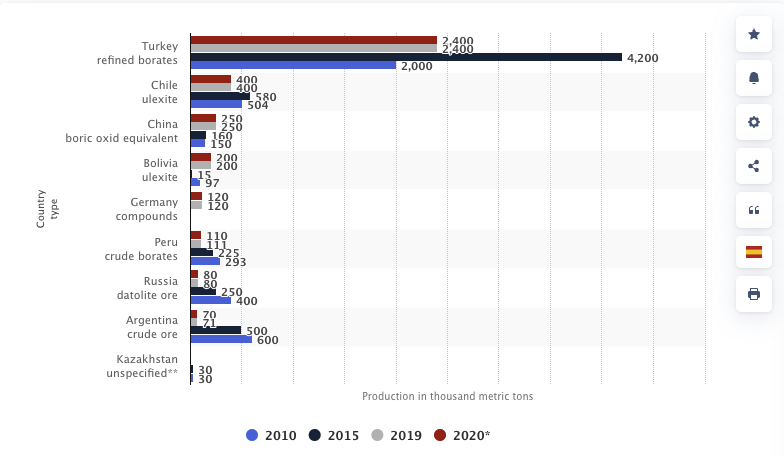

Country Profile of Russia: Russia is the seventh largest supplier of boron to global markets just above Argentina, but far below first place producer Turkey, which produces about 52% of the global total. While the current Ukraine conflict is not having a noticeable impact on supply and production in the short term for borates supply, the situation needs to be monitored.

![]()

Country Profile of Russia

Boron Mineral Resources

Boron’s importance is expanding due to the world’s fast depletion of raw material resources and its use in a variety of sectors. Supply of Boron is primarily from Turkey, followed by Chile, China, Bolivia, Germany, Peru and then Russia.

Boron Global Reserves- Statista

Reserves of Boron in Russia

Boron reserves in the Russian Federation amounted to more than 1,000 million tonnes (1 GT). This figure includes both known and unknown resources.

DEPOSIT LOCATION ORE TYPE % RUSSIAN TOTAL

Dainegorskoye Far East Region Borosilicates 67.92

Tayozhnoye Sakha-Yakutia Boron-containing iron ores 31.64

Munt Zolotoy Kurgan Stavropol Region Borosilicates 0.44

Source: Substack

Approximately 8.6 billion tons of borates are estimated to have been discovered in 2004 by the Ministry of Industry and Commerce. It is estimated that 5.3 billion tons of these deposits are located in Siberia.

Russian mines produce five main types of borates today: boric acid, calcium tetraborate, sodium tetraborate, potassium tetraborate, and lithium tetraborate.

Borate mining has, however, declined sharply since the early 1990s due to a combination of factors, including low prices, increased competition from China and India, and environmental concerns. As a result, the number of mines producing borate products has dropped from more than 100 in 1991 to fewer than 30 today.

The decline was particularly severe in the Urals region, where a large proportion of existing borate deposits are located. Production of borax fell by almost 50 per cent between 1993 and 2001, while that of boric acid decreased by nearly 80 per cent.

In terms of boron production, Russia ranked seventh in the world in 2019, with total boron production of 80,0000 metric tonnes.

Russia imported $773k of boron while exported $38.5 millions in 2019. According to the UN’s COMTRADE database on international trade, the United States exported $8.93 million worth of Borates and peroxoborate (perborates) to Russia in 2021.

The Russian Bor CJSC Mining Chemical Company is Russia’s largest producer of boric acid. Furthermore, it is a world leader in the production of boron-containing products such as boric acid and datolite concentrate.

Boron Locations in Russia

Siberia, Central Asia, and Eastern Europe are the main regions where mining operations are concentrated.

Russia’s mining industry is, however, concentrated almost entirely in Siberia. Five federal districts are part of Siberia: Khabarovsk, Krasnoyarsk, Magadan, Novosibirsk, and Omsk. These districts occupy seventy per cent of the total area of the country. Borates, barites, gold, iron ore, coal, oil shale, and other valuable mineral deposits can be found in these regions.

Central Asia has also been a significant mining region in recent years. In addition to covering the territory of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan and portions of Afghani and Mongolian territory. Borates are not known to exist in this region.

Domestic Producers of Boron Compounds

JSC Aviabor

In 1960, Aviabor was founded at Dzerzhinsk in Nizhny Novgorod region as a high-tech military facility for producing boron compounds used in weapons, space exploration, and missiles. The company is Russia’s only producer of boron hydride and associated boron compounds. In 1993, the company became a privately-owned joint-stock company.

Aviabor’s product range includes borane complexes, borohydrides, organoboranes, boronic acid, borates, and other speciality compounds.

MMC BOR

The Bor Corporation is Russia’s sole integrated producer of natural borates and boric acid. In addition to datolite concentrate, the company produces calcium borate, boric anhydride, boric acid, and sodium perborate. Russia produces more than 95% of the total amount of boron-containing products. Datolite has been extracted from the mine and its predecessors since 1959. There are sufficient reserves and resources to sustain mining for 75 years at current mining levels.

Klyuchevskoy Ferroalloys Plant

In 2008, the Sverdlovsk region’s “Klyuchevskii Ferroalloy Plant” (KZFS) began producing ferro-boron, and it has since switched to more than 200 tons per year.

NLMK

NLMK, formerly known as Novolipetsk Steel, ranks among the largest steel companies in Russia. The share of NLMK in domestic crude steel production is approximately 21%. Its primary products are flat steel products, semi-finished steel products, and electrical steel. Among the products that NLMK manufactures are coated steels of high ductility and micro-alloyed steels. The company is the 21st largest steelmaker in the world.

Other Domestic Producers of Boron Compounds

Three Russian companies produce boron compounds: CJSC KrasnyKhimik, JSC Reactiv, and JSC Stavropol Inorganic Chemicals.

Effect of Conflict on Russian Trade

The conflict between Ukraine and Russia has significantly impacted Russian imports across the board. Putin has responded in kind by setting up lists of export products to be banned, including a blacklist of commodities and raw material exports. A broad export ban on other strategic raw materials like nickel or wheat would put additional pressure on already tight commodity markets as prices surge amid Ukraine.

As a case in point for critical minerals, Russia is one of the world’s largest suppliers of Palladium, about 40% of which is mined in Russia, The metal shot to a record high in early March, 2022 due to nervousness over banking restrictions banks and worries over flight bans making it difficult to supply global customers. It has since dropped as it seems exports won’t be affected as first thought but is still up more than 40% this year. See the Wood Mackenzie webinar below for more details.

This may be a proxy of things to come on a smaller scale for supplies of borates to Russia’s key export markets with a knock-on effect of higher prices which may benefit other borates producers while uncertainty around the conflict remains.

Wood Mackenzie Seminar – Russia Commodities

For those interested in Russian exports of key commodities, a detailed overview of gas, oil, coal, metals and mining is given by Wood Mackenzie in an overview here. A potential reduction of borates supply is not discussed, suggesting a minimal impact on supplies for global markets., although steel and other exports where boron is applied as a protective coating for tensile strength may affect production in construction and automotive sectors for example.