The Boron Carbide Market: An Overview

Global boron carbide sales are estimated to reach US$ 141.2 million in 2022 and are predicted to rise at a robust 4.2% CAGR over the forecast period (2022-2029). This rise results from growing demands for abrasives and refractory materials from various end-use industries, including the construction, automotive, aerospace, and electronics sectors. Furthermore, market growth over the upcoming few years is anticipated to be fueled by its increasing use in nuclear applications.

Boron Carbide

Boron Carbide (B4C) is a ceramic material of boron and carbon. It is among the hardest known materials, with a Moh’s hardness of 9.3. It is an abrasive for polishing and lapping applications, water jet cutting, and grit blasting. The compound can also be used in composite armor, providing excellent resistance to penetration by high-velocity projectiles.

Boron carbide ceramics have a wide range of industrial and military applications. They are used in bulletproof vests and armored vehicles, industrial cutting tools and wear-resistant coatings, and nuclear reactors as control rods due to their high neutron absorption cross-section.

Market Insights to June 2022

The demand for nuclear energy and sustainable energy sources will increase, driving the boron carbide market. It is an ideal material for industrial tools and equipment due to its hardness, chemical inertness, and effective neutron absorption, fueling the market’s further expansion.

The first half of 2021 saw a 4.5% increase in global demand, while the first half of 2022 had a 4.7% increase. Additionally, due to the diverse growth prospects of the end-use industries, the market’s growth is predicted to be very uneven. India and China will have stronger growth prospects, while the European countries will experience a moderate growth outlook.

Market History and Forecasts

In contrast to the 4.1% CAGR observed between 2014 and 2021, the carbide industry is forecasted to rise at a 4.2% CAGR between 2022 and 2029. This is mostly due to the industry’s growing need for boron carbide nanoparticles for manufacturing hard metal equipment. Additionally, the market will benefit from the increased demand for more active composite materials for defense applications and boron carbide coating in treating brain tumors.

Industries Leading Market Growth

1. Health Industry

According to the American Society of Clinical Oncology (ASCO), there will be approximately 10,880 women and 14,170 men diagnosed with cancerous brain and spinal cord tumors in the U.S. in 2022.

This year, approximately 4,170 kids under 15 will be treated for brain tumors. Thus, the rising incidence of brain cancer worldwide will increase the demand to improve treatment outcomes.

2. Nuclear Energy Industry

The nuclear energy sector will experience significant growth in the coming years, likely boosting demand for boron carbide powder. According to the World Nuclear Association, 30 nations are globally exploring or planning nuclear power projects. Turkey, Bangladesh, and Belarus are already building their first nuclear power plants.

This increased activity in the nuclear sector will require more of this compound for special applications in nuclear reactors. Additionally, it serves as protection against radiation. Boron carbide powder can withstand extremely high temperatures and is highly resistant to chemical and radiation attacks, making it an ideal material for use in the nuclear industry.

3. Defense Industry

With developing and developed countries looking to increase their defense expenditure to strengthen their current armed forces, the global demand will increase. The market will support the increased production of vehicle and protective body armor systems.

4. Abrasives Segment

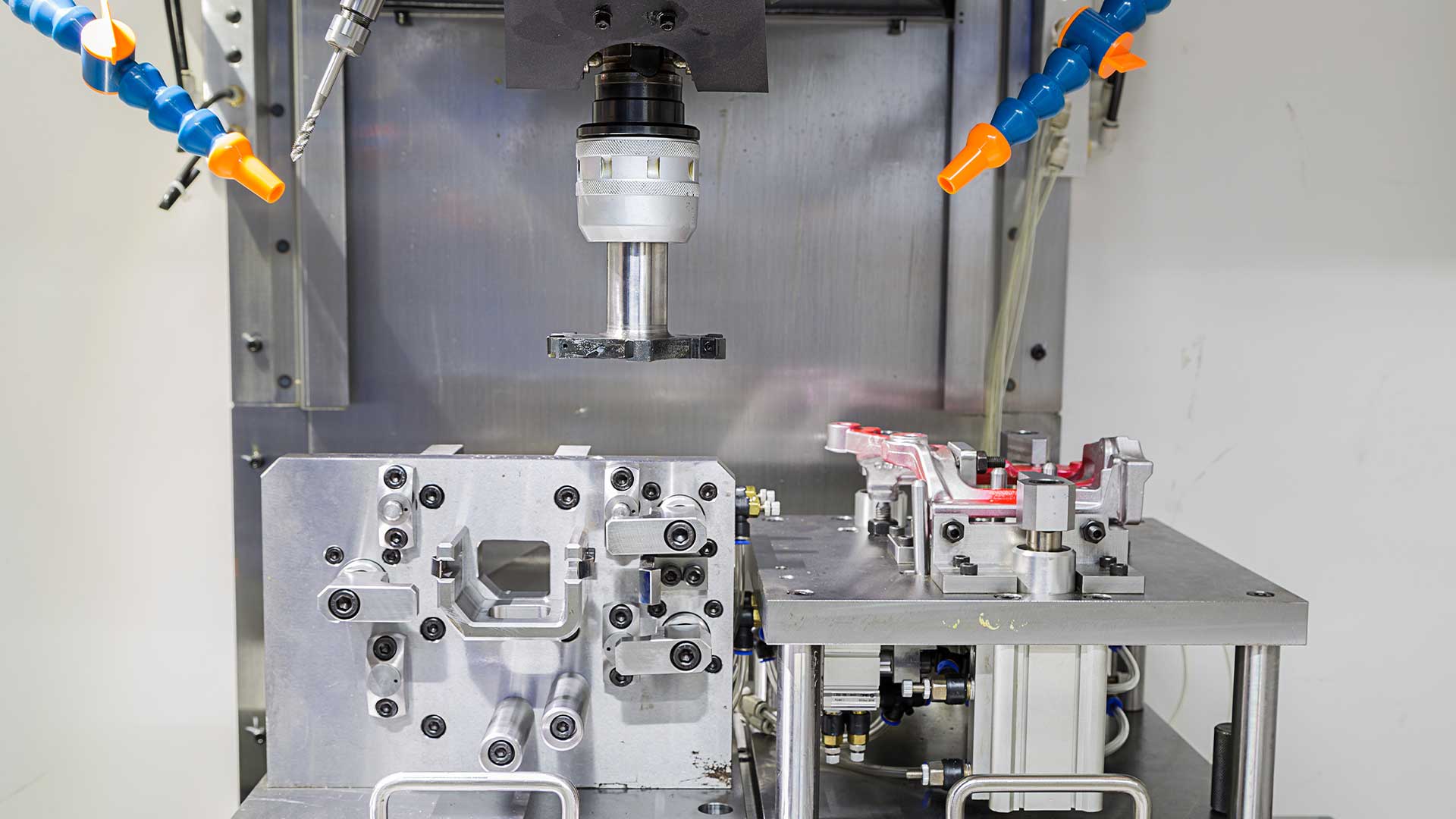

The abrasive industry will dominate the global market throughout the assessment period. Because of its excellent hardness, boron carbide coating is widely utilized as an abrasive in lapping and polishing applications.

It is also applied as a loose abrasive in numerous cutting applications. It is the perfect material for diamond tool dressing and nozzles for water jet cutting, slurry pumping, and grit blasting.

5. Powders Segment

The powder market will dominate over the next few years regarding product type. Around the world, companies that polish, grind, and sinter hard metals frequently use carbide powder.

Due to its excellent thermal stability and melting point, it is also used in refractory applications. It performs effectively in ballistics due to its high hardness and low density. Before using it in commercial products, the powder is frequently crushed and cleaned to eliminate metallic impurities.

Countries Leading Boron Carbide Market Growth

1. China Market

China’s established metal industrial base is expected to drive the market over the forecast timeline. According to future market insights, the APEJ (the Asia Pacific excluding Japan) market will account for around 32.2% of the total in 2022.

According to the Reserve Bank of Australia (RBA), China’s 10 leading steel makers contributed under 50% of crude steel production in 2009, with the remaining 75 enterprises accounting for an extra 30%. Most significant Chinese manufacturers are state-owned, and the arrival of more private metal manufacturing enterprises into the nation is likely to boost boron carbide fiber demand.

2. German Market

The deployment of modern technologies by organic boron carbide producers for the manufacturing of high-quality materials is a key factor driving the market in Germany. According to future market insights, the B4C market in Western Europe will account for 25.3% of the market’s overall share in 2022.

German manufacturers are optimizing materials’ boron concentration. They are also using abrasives for ultrasonic boring since they can be used to bore hard and brittle materials.

3. US Market

By application, the armor sector will lead the worldwide boron carbide market. Its growing use in protective gear, particularly ballistic vests, is likely to drive the industry.

SINTX Technologies, Inc. signed an asset purchase contract with B4C, LLC in July 2021 to get the technical procedures and equipment needed to produce ballistic armor plates. The company intends to commercialize and produce pure boron carbide for defending soldiers from elevated, hardened projectiles.

Key Companies in the Boron Carbide Market

The global market research provides a few important market players, including 3M Company, U.K. Abrasives, Inc., 5E Advanced Materials Inc (5E). For instance, 5E has a long-term goal of establishing a business for boron advanced materials, leveraging feedstock out of its Fort Cady operation to produce these greater, high-value boron compounds that sell for various price factors.

Boric acid and its derivatives (carbides, nitrides, etc.) are currently the most appealing financial opportunity in the 5E Advanced Materials Inc. This is because boron-containing compounds (specifically Ferro boron/boron carbide) are used, together with iron, neodymium, and other trace minerals, to fabricate permanent magnets for electric vehicles, wind turbines and other applications with a long runway vs. a strong demand backdrop.

While boron consumption is predicted to expand at a 6% CAGR through the 2020s, advanced boron materials are forecast to increase some hundred basis points faster due to decarbonization-related applications.