New Suppliers Ramp up for Production

Boron, number 5 on the periodic table, finds its essential role in decarbonization and electric vehicles. Boron plays a vital role in reaching safer climate targets via new materials that are more efficient and more environmentally friendly.

Boron Mining Suppliers

Boron

Boron is mentioned more and more in discussions about decarbonization and electric vehicles (EVs). However, this element has many other applications as a nutrient for plants. It is found in fertilizers which help produce healthy food sources. It is also used in high-tech applications such as heat-resistant glass for smartphones, renewable energy materials, wind, and solar developments, ceramics, and fiberglass insulation.Dynamics of Global Demand and Supply

Boron is a topic of discussion in geopolitical supply management strategies for commodities, such as discussion on oil and gas as a political weapon in Russia, dominance in rare earth production in China, and bans on coal exports due to domestic supply concerns in markets like Indonesia.As things stand at the moment:

- Turkey and its state-owned assets account for 60% of the global supply country.

- Eti Maden and Rio Tinto account for 85% of global supply by the producer (ASX: RIO)

- China supplies 80% of downstream processing (i.e., boron carbide).

- Demand growth is expected to be explosive in the long term due to key decarbonization sectors.

- Increasing demand and a shortage of near-term supply alternatives are expected to widen the gap over time.

- 5EA estimates that there will be a potential shortfall of approximately 2 million tonnes of boric acid equivalent by 2028.

Boron Players on the Australian Securities Exchange

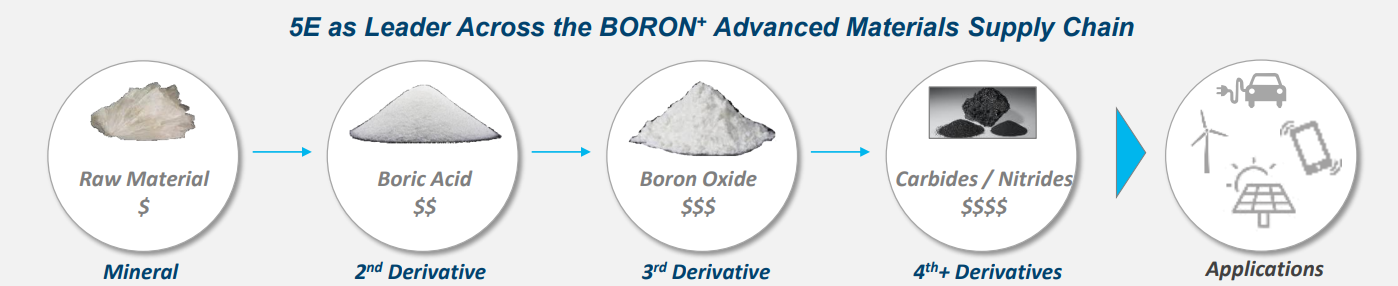

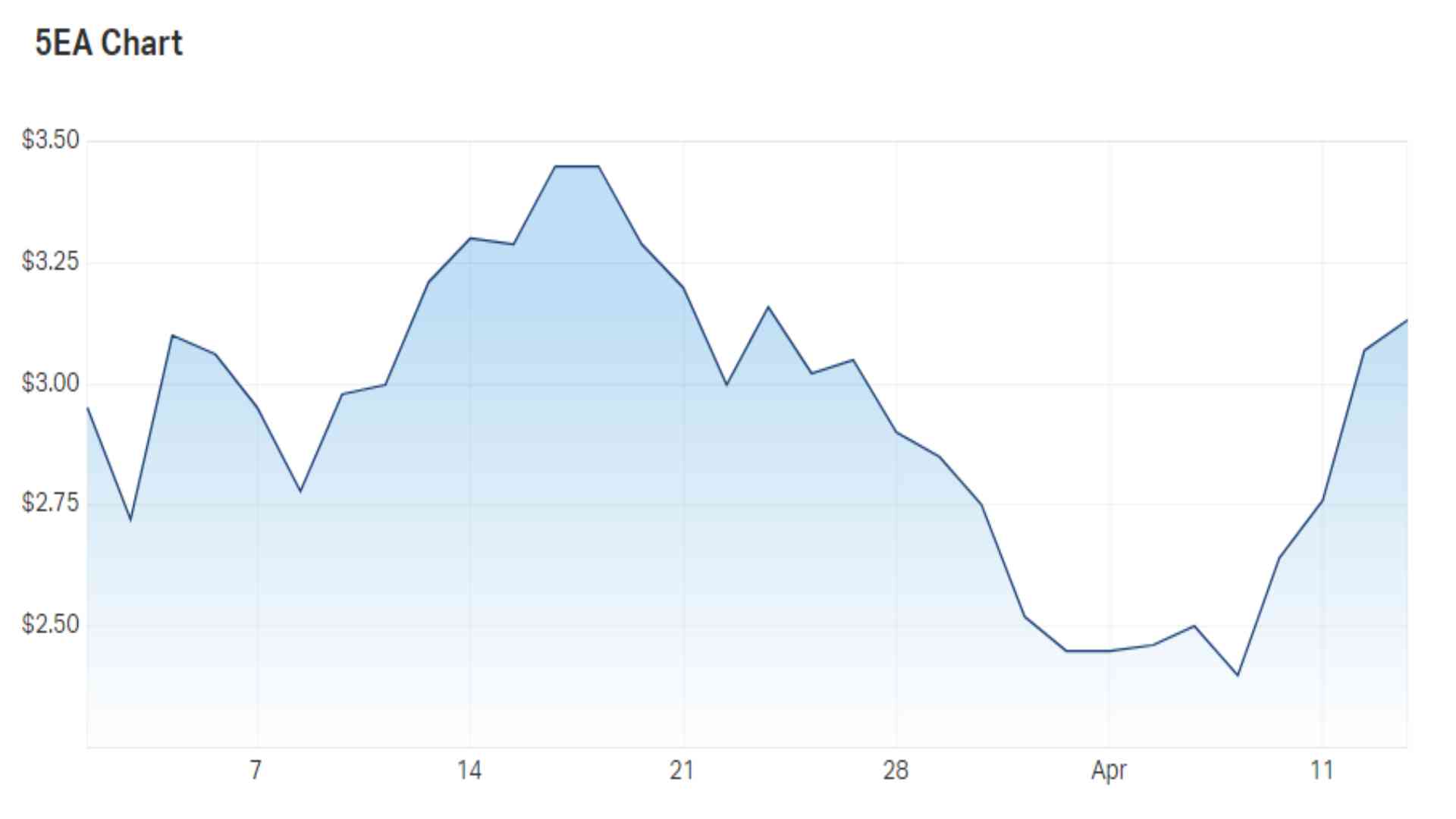

5E Advanced Materials (ASX: 5EA) is the most pure-play boron stock, which was earlier known as American Pacific Borates (ASX: ABR). As part of its Fort Cady Project, American Pacific Borates has 327 million tonnes of reserves, enough for more than 70 years of annual global demand. The company has recently been given a license to extract boron by the US Government and is currently preparing the facility for production. As part of the company’s rebranding from American Pacific Borates, 5EA is aiming to become a fully integrated boron products business that extends the value chain. align=”alignnone”] Boron value chain[/caption]

Another turning point for the 2022 calendar year is the completion of Fort Cady’s Bankable Feasibility Study (BFS), as well as the advancement of commercial partnerships and supply agreements.

Subject to the BFS, Fort Cady’s goal is to produce more than 400,000 tons of boric acid by 2024.

Boron value chain[/caption]

Another turning point for the 2022 calendar year is the completion of Fort Cady’s Bankable Feasibility Study (BFS), as well as the advancement of commercial partnerships and supply agreements.

Subject to the BFS, Fort Cady’s goal is to produce more than 400,000 tons of boric acid by 2024.

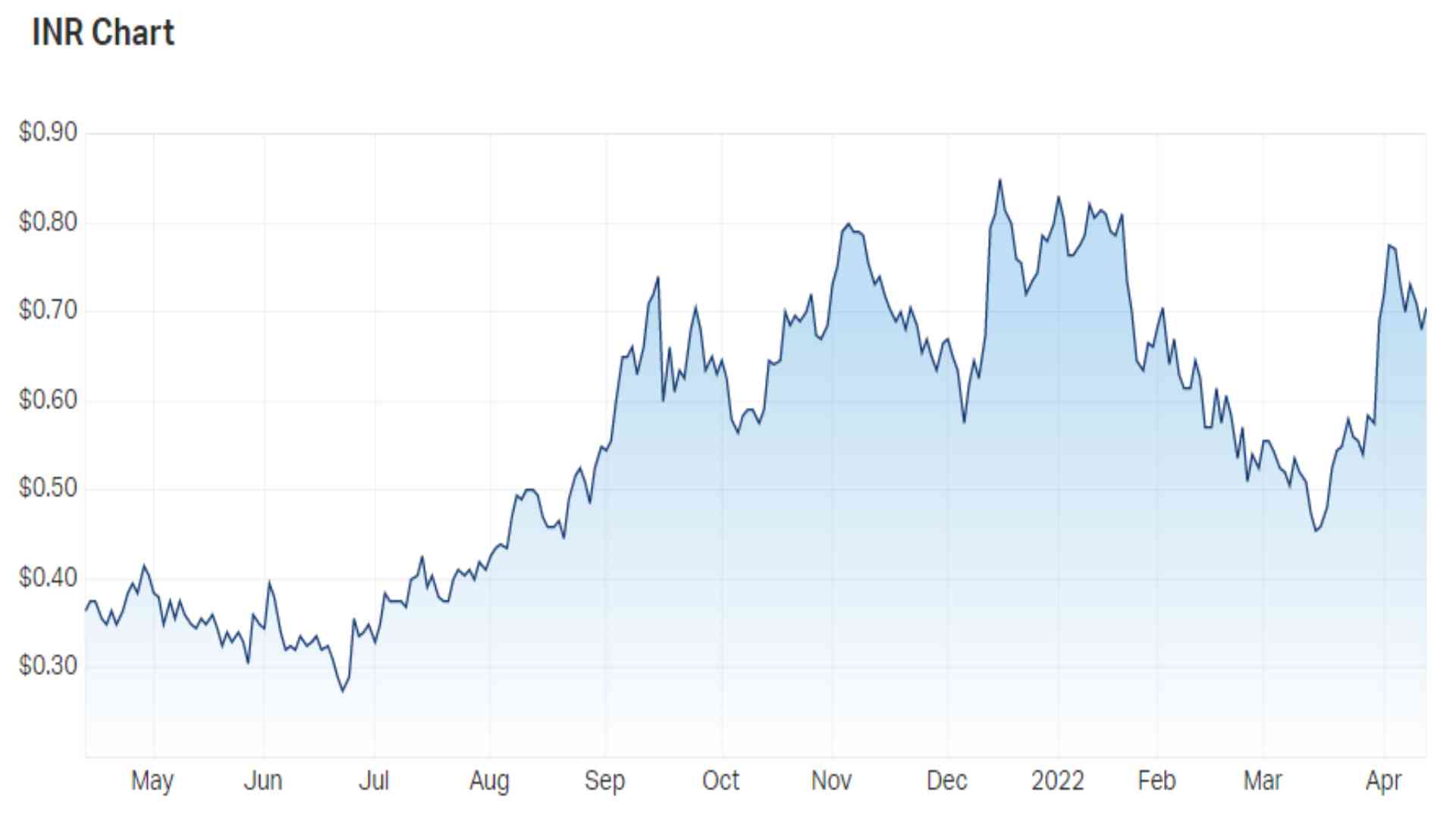

boric acid

lithium carbonate