Demand BORON PUSHES Share Prices Up

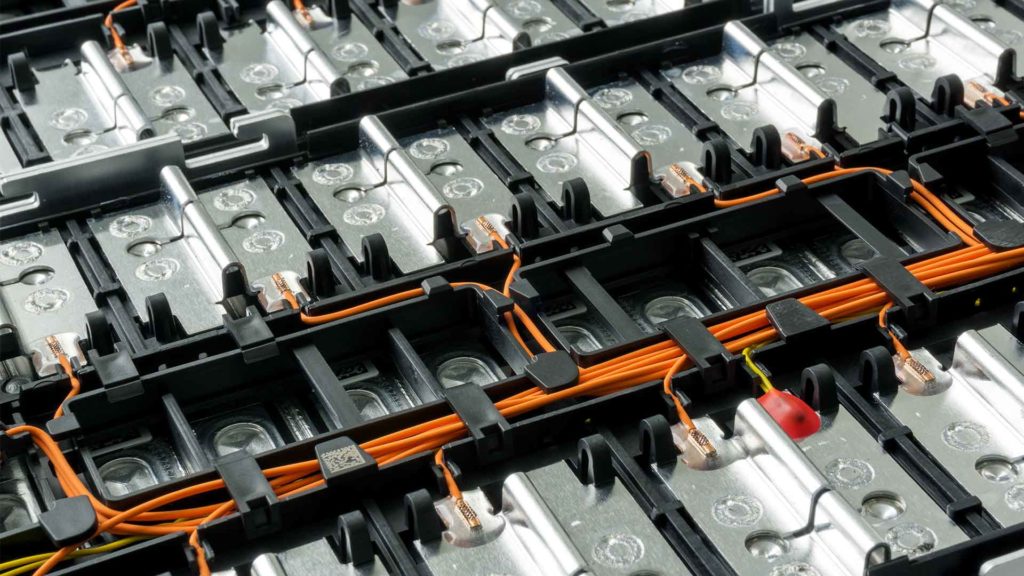

The clean energy shift is happening, and it’s more than just an environmental movement. As more people turn to renewable sources of power, the demand for battery minerals is increasing exponentially worldwide. Boron, lithium, and graphite are essential minerals seeing increased share prices because of this trend.

Mining companies are not the only ones who have seen their share prices soar. Battery mineral firms also enjoyed a boost as funds managers predicted that there would be strong investment demand for cleaner energy sources in the coming years. One of those significant themes was batteries to power electric cars on paved roads.

An economic study of both markets

A record-breaking $10 billion was returned to shareholders last month after three of the world’s largest mineral companies took out dividends. Rio Tinto, BHP Group, and Fortescue Metals Group have provided their investors with solid returns over the years because they can invest back into growth projects and have constantly been working on research and development to decarbonize their corporations further.

Surging prices for Rare earth Metals

Looking at the prices of rare earth minerals and their exponential increase over the last year, it is clear that there are powerful driving forces behind the rise in prices. But, what are these driving forces that have doubled the prices of elements like Lithium, Nickel, and Copper?

- Environmental factors – As the clean energy shift happens, it is clear that demand for minerals will increase as more and more people turn to battery power rather than fossil fuels.

- Political factors – China has been limiting its exports of rare earth metals over the past year with several new regulations, which have led to an increase in prices worldwide. As a result, countries like Japan are now trying to develop ways to produce these elements themselves without having to rely on Chinese trade. However, this concern over China’s monopoly is also shared by the EU that is adamant about a fair distribution mechanism of rare earth minerals for scientific progress and the adherence to the Sustainable Development Goals set by the United Nations.

- Increasing production costs – Mining companies worldwide need higher returns from each tonne mined, so they’re beginning exploration into areas where there’s less competition and higher risk/rewards, such as deep-sea mining or drilling under ice sheets where extraction is much more complex due to harsh climate conditions.

However, the growth exhibited by these companies was well under the radar because of a dominating interest in the iron ore markets by many investors. Now that we’re moving into the age of decarbonization and policy changes are encouraging companies and consumers to go green, the growth rate of battery materials is on the rise. This is one of the many reasons investors are now re-assessing their portfolio and strongly considering the addition of this sector as a viable financial opportunity.

Decarbonization supercycle to benefit local miners – Experts

Investors are betting on a new era of resource-focused mining, and it’s not just for Australia. For the past year or so, we’ve seen an increased interest from global funds in lithium mines across Asia, especially with many Australian companies currently focused on renewable energy production instead despite its high cost compared to other sources. Due to this, miners within the niche of mining rare earth minerals have seen higher share prices and newfound support from investors over the past 12 months.

This is set to open the business landscape for many new and upcoming players.

Challenges procuring battery minerals

The battery minerals industry has been in a challenging place for the last year as demand outpaced supply. It’s only now that this trend appears to be turning around, with policies AIMED at encouraging cleaner energy production and electric vehicle sales driving up the interest in materials like lithium that are necessary components to modernize our transportation systems. It’s not an overstatement when we say there have been some problems within the industry regarding sustainable development, but newer regulations, governmental support, global collaborations, and development of new means of technology to optimize energy usage as well as maximize means of production will be tackling the issue over the next couple of years.

Forecasting demand FOR BATTERY METALS

The battery metals will be a reliable investment for the next decade, according to Argonaut Funds Management. Their top five stocks are OZ Minerals, IGO, Pilbara Minerals, Lynas Corp., and Orocobre. The investment world is abuzz with talk of a possible bull run in the sector. However, many investors will need to be willing to pay up for stocks on this ride and prepare themselves as there may very well be some short-term losses along its path forward given the current valuations.

All in all, while the market has its fair share of volatility over the next decade, it is about one of the most financially lucrative business opportunities for long-term investors who have the resources to invest in these companies and hold their portfolio over the next 10-15 years.

While Copper and Nickel have seen a massive increase in demand and prices, Lithium stands out with record-breaking forecasted demand, which ascertains the vital relevance of the mineral and the financial future of Lithium mining companies.